Pump and Dump Scams: The Modern Investment Trap

The rise of cryptocurrencies has drawn in a lot of regular people and big businesses, but everyone should be careful of "pump and dump" schemes. This "digital gold rush" has created new chances, but it has also attracted scammers who want to take advantage of the mostly unregulated market. "Pump and dump" scams are among of the most common schemes. They are a sort of market manipulation that can cost investors a lot of money if they buy shares at a higher price.

What Is a Pump and Dump Scheme? Understanding Investor Risks

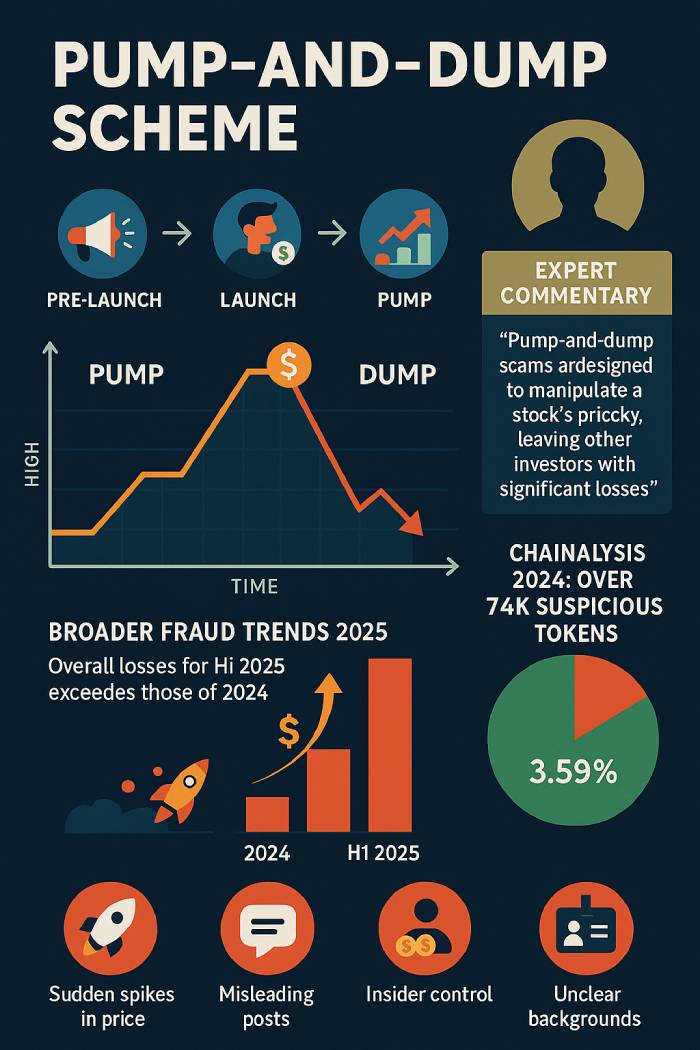

A pump-and-dump scheme is a fraudulent tactic where a group of fraudsters buy a large volume of a cheap or thinly traded asset—often a cryptocurrency, microcap stock, or penny stock—then artificially inflate the price by spreading false and misleading positive statements. Once the price of the stock or crypto token is artificially inflated, these scammers sell their shares at a higher price, causing the price to crash and leaving other investors with massive losses.

In the world of cryptocurrency, such scams have become increasingly common. A classic pump involves a promoter or influencer hyping up a coin or token via social media, Discord, or Telegram. The dump happens once the fraudster offloads their holdings, causing the stock price to fall and triggering a price collapse. The entire process—from buzz to bust—can happen in hours.

"These schemes often target less experienced traders with access to an online trading account," says Alex Zeltser, a compliance expert. "They create the illusion of opportunity through artificially inflated trading volume, a hallmark of ‘pump and dump’ schemes, often by spreading false or misleading information."

Pump and Dump Scheme Trends: A Growing Investor Scam

Chainalysis says that more than 2 million tokens were added to the crypto market in 2024. About 870,000 of those were traded on decentralized exchanges, which have less control and are therefore more likely to use "pump and dump" techniques. More than 3.5% of these tokens acted in ways that were consistent with pump-and-dump manipulation, which caused prices to go up and mislead investors.

Fraudsters made millions through ‘pump and dump’ schemes, and investors lost billions as they bought into artificially inflated prices, only to see the price falls. The FBI reported U.S. investors alone lost $9.3 billion to cryptocurrency scams in 2024, a large share of it linked to investment schemes like the “pump and dump” that involve artificially inflating the price.

Dr. Lila Chen from the University of London explains: "These scams play on emotion, not logic, especially when they involve brokers who promote false claims." They weaponize FOMO to drive up the price of a stock quickly before executing their ‘pump and dump’ strategy, leaving other investors with significant losses. It’s less about the price of a security and more about controlling the investor mindset."

Inside the Pump-and-Dump Scheme: How Promoters Manipulate Stocks

- Pre-PumpA group of promoters or a boiler room operation begins spreading hype, often using tactics reminiscent of those employed by Jordan Belfort. This may include stock touts or crypto influencers urging readers to buy the stock quickly, often leading to a ‘pump and dump’ situation.

- PumpThe price is artificially inflated through coordinated buying and false narratives—such as claims of partnerships or imminent exchange listings—before the price falls dramatically.

- Dump: Once the price of the stock or token hits its peak, the scammer dumps their shares, causing the price to fall rapidly.

- Aftermath: The asset becomes virtually worthless. The promoters vanish, and investors lose their money.

Wolf of Wall Street Pump and Dump Scheme: Lessons from Penny Stocks

Pump-and-dump scams aren't new. In traditional finance, similar tactics were used to manipulate penny stocks and micro-cap stocks, often through over-the-counter exchanges with low trading volume. Jordan Belfort—infamously known as the “Wolf of Wall Street”—built his brokerage firm, Stratton Oakmont, on such schemes, manipulating the stock price of companies and leaving other investors devastated.

Spotting a Pump and Dump Scam: Warning Signs for Investors

- Unusual spikes in trading volume can often indicate a ‘pump and dump’ scheme in action, alerting investors to potential fraud that involves selling the cheaply purchased stock at a higher price.with no accompanying news.

- Overly promotional contentfrom stock promoters or crypto influencers.

- Anonymous foundersor promoters with unverifiable backgrounds, often linked to securities fraud that involves spreading false or misleading information to potential investors.

- Price of an owned stock rising rapidly, especially in thinly traded markets.

- Stock through false and misleading statements, including fake partnerships or development claims often related to securities fraud that involves artificially inflating the perceived value of an asset.

- Lack of community engagementor restricted comment sections on social platforms.

"When a project disables questions or discussion, that’s your first red flag," says Melinda Nash, a forensic blockchain investigator.

Pump-and-Dump and the Law: SEC, Securities Fraud, and Regulation

Pump-and-dump techniques are illegal in regulated marketplaces like the New York Stock Exchange because they raise the price of a stock to trick people into buying it. The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) go after these kinds of crimes quite hard.

But the cryptocurrency market is still less regulated, which makes it a good place for fraud to happen, such "pump and dump" schemes and trading with little volume. Because it is decentralized, scammers can do a "pump and dump" and then move across borders, making it harder to hold them accountable. Agencies like the SEC are catching up on enforcement, but it is still limited.

Jordan Malik, an SEC adviser, adds, "We need global standards and tools for real-time transparency." "Otherwise, pump-and-dump scams will keep making people lose faith in digital markets."

Investor Pump and Dump Awareness: Staying Ahead of the Scam

Pump-and-dump scams are designed to manipulate a stock or crypto token, inflate its value artificially through pumping up the price, and dump their shares at a profit—leaving other investors with significant losses. Whether it’s bitcoin, a new microcap altcoin, or a company’s stock traded over-the-counter, the risk remains high, especially in schemes that involve ‘pump and dump’ tactics.

How to keep oneself safe? Take care. Check the claims. Take a look at how tokens are given out. Check to see whether promoters have a history of spreading false or misleading information. Also, don't make financial decisions based purely on excitement or hurry, because this could get you ensnared in a "pump and dump" scheme.

When individuals are angry and don't know the truth, these scams function best. But if investors are diligent and educated, they might not be the next victim of the latest "pump and dump."