How Cryptocurrencies Are Taxed In India 2024

Cryptocurrency, a form of digital currency, is designed for purchasing goods and services, similar to traditional currencies. It operates independently of centralized authorities like banks and financial institutions, which has been a source of controversy since its inception. Presently, the global digital currency space trades more than 1,500 types of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Dogecoin, Ripple, and Matic, with significant investments pouring into their trading.

In India, cryptocurrencies and non-fungible tokens (NFTs) remain unregulated. An attempt by the Reserve Bank of India (RBI) to ban cryptocurrencies in 2018 was overturned by the Supreme Court, leaving their legal status in a gray area—neither fully legal nor explicitly illegal. Similarly, NFTs have not faced as much regulatory scrutiny but share this uncertain legal status. Although there have been discussions regarding a comprehensive Cryptocurrency Bill, the Indian government has not yet made such legislation public, and its regulatory approach to cryptocurrencies and NFTs remains unclear.

In the interim, the government has implemented a tax regime specifically for virtual digital assets (VDAs) like cryptocurrencies and NFTs. This regime imposes a 30% tax plus a 4% surcharge on gains derived from trading, swapping, or selling these assets, whether treated as business income or capital gains. However, this taxation does not extend to vouchers or gift cards. Despite these measures, the broader legal framework for cryptocurrencies and NFTs in India continues to be ambiguous, impacting how these digital assets are viewed and used within the country.

Are Cryptocurrencies Taxed in India?

Yes, cryptocurrencies are taxed in India. The taxation of what are classified as "Virtual Digital Assets" (VDAs) was officially established in the Union Budget 2022, introduced by Finance Minister Nirmala Sitharaman. This category encompasses all cryptocurrencies like Bitcoin and Ethereum, as well as other digital formats such as Non-fungible Tokens (NFTs). This legislative update marked a significant change, officially recognizing these assets within the financial system of India.

Profits from transactions involving these digital assets are subject to taxation, indicating the government's stance on regulating and integrating cryptocurrency into the broader economic framework. The move aims to provide clarity and structure to the crypto market, ensuring that all transactions are accounted for within the country's tax regime. This guide aims to navigate the complexities of crypto taxes in India following these regulatory changes.

Understanding Virtual Digital Assets: Are They Currencies or Assets?

In the context of Indian tax law, cryptocurrencies and non-fungible tokens (NFTs) fall under the category of "Virtual Digital Assets" (VDAs), as defined by Section 2(47A) of the Income Tax Act. This definition is quite comprehensive, covering any information, code, number, or symbol derived through cryptographic means, which is not recognized as Indian or foreign currency. Essentially, this encompasses all types of crypto assets, including NFTs, tokens, and cryptocurrencies, but explicitly excludes traditional digital assets like gift cards or passes.

Virtual Digital Assets are defined as digital representations that lack physical or tangible form. In simpler terms, this category includes cryptocurrencies, decentralized finance (DeFi) applications, and NFTs, but notably excludes digital gold, central bank digital currencies (CBDCs), and similar traditional digital assets. The main focus of this classification is to facilitate the taxation of cryptocurrencies and related digital assets, marking a significant step in the regulatory landscape that seeks to address the evolving nature of digital financial instruments.

How Crypto Taxation In India Works

In India, cryptocurrencies and non-fungible tokens (NFTs) are defined as "Virtual Digital Assets" (VDAs) under the Income Tax Act, significantly clarified during the Budget 2022 session. This comprehensive definition includes any type of data, code, number, or symbol not recognized as Indian or foreign currency but created through cryptographic means or otherwise. This broad category encompasses all cryptocurrencies, tokens, and NFTs, but explicitly excludes traditional digital assets like gift cards or passes.

The tax implications for transactions involving these digital assets are specific:

- Income derived from the transfer of VDAs is taxed at a flat rate of 30%, with an additional 4% health and education cess.

- The only deductible expense allowed when calculating taxable income from VDAs is the cost of acquisition.

- Losses from the transfer of one type of VDA cannot be set off against gains from another, nor can they be offset against any other type of income.

- Gifting of VDAs results in the recipient being liable for taxes on the market value of the gift.

From July 1, 2022, a 1% Tax Deducted at Source (TDS) applies to any VDA transaction exceeding specific monetary thresholds within a fiscal year, as specified under Section 194S. Additionally, under Section 206AB, individuals who have not filed their income tax returns for the last two years and have a TDS deduction totaling INR 50,000 or more in each year will face a higher TDS rate of 5% on cryptocurrency-related transactions.

Despite the regulatory framework for taxation, the broader legal status of cryptocurrencies and NFTs remains somewhat ambiguous in India. The government has not yet fully clarified which types of NFTs or additional digital assets will be officially notified under the VDA category for taxation purposes, leaving some room for interpretation and potential future regulation. This ongoing uncertainty suggests that stakeholders should remain cautious and up-to-date with any legislative changes.

Tax Implications for Cryptocurrency Transactions in India

In India, cryptocurrency transactions are subject to a tax rate of 30%. This encompasses a wide range of activities, including using cryptocurrencies to purchase goods or services, exchanging one cryptocurrency for another, dealing in cryptocurrencies with fiat currency such as the Indian Rupee (INR), receiving cryptocurrency as payment for services, as a gift, or as part of mining operations. Additionally, earning cryptocurrency through staking or as a salary, and receiving airdrops, are all taxable events.

The specific tax liabilities under the Income Tax Act are as follows:

- If a person acquires a Virtual Digital Asset (VDA) without consideration and the fair market value of the asset exceeds INR 50,000, the total market value is taxable in the hands of the recipient at their applicable income tax rate.

- If a VDA is received for consideration less than its fair market value, and the fair market value exceeds the paid consideration by more than INR 50,000, the difference is taxable as income at the recipient's applicable tax rate.

- Income from the transfer of a VDA, reduced by the acquisition cost, is also taxed at 30%. Additionally, there is an equalization levy of 2% applied to transactions involving non-resident entities that own the blockchain where NFTs are traded.

These regulations reflect the Indian government’s approach to integrating cryptocurrency transactions into the existing financial and tax systems, ensuring that the gains from these digital assets contribute to the national economy while providing a legal framework for their taxation.

How To Calculate Taxes On Crypto In India

In India, all cryptocurrency transactions are subjected to a uniform tax rate of 30%, regardless of whether they involve crypto-to-crypto trades, crypto-to-fiat exchanges, or usage for purchasing goods or services. This rate applies equally to retail investors, traders, and any entity involved in transferring crypto assets. Importantly, the tax rate is consistent across both short-term and long-term gains without any distinction.

Key Points on Loss Set-off and Tax Calculations:

- Losses from the sale or transfer of Virtual Digital Assets (VDAs) cannot be offset against gains from other types of income or even different VDAs within the same financial year.

- Tax is levied on the net gains realized from these transactions, calculated as the difference between the selling price and the cost price.

- The specific tax treatment also extends to receiving cryptocurrencies as gifts valued over INR 50,000, where the full market value becomes taxable in the hands of the recipient.

Example Scenarios:

- If you invested INR 100,000 in a cryptocurrency and sold it later for INR 150,000, the taxable gain would be INR 50,000, resulting in a tax liability of INR 15,000, plus applicable surcharge and cess.

- In a scenario where you purchase Bitcoin for INR 5 lakh and sell it for INR 6 lakh, and simultaneously sell Ethereum bought for INR 2 lakh at INR 1.5 lakh, the net taxable income would be INR 1 lakh, attracting a tax of INR 30,000.

Tax Deduction at Source (TDS) on Crypto Transactions:

- From July 1, 2022, a 1% TDS applies to all crypto transactions, including purchases and sales. This TDS is deducted at the point of transaction and is applicable whether the transaction is handled through an Indian exchange or involves P2P dealings.

- It’s essential for individuals to manage and file TDS, especially in P2P or foreign exchange scenarios, to ensure compliance with tax obligations.

This framework ensures all cryptocurrency transactions are taxed at the time of transfer, providing clarity to investors about their tax liabilities. The Indian tax system requires careful tracking of all such transactions to meet the compliance requirements accurately.

How Will the 30% Crypto Tax be Applied on Crypto as Salary?

In India, the 30% tax on cryptocurrency transactions also applies to any income earned in the form of cryptocurrency, including salary. This tax is levied irrespective of the individual’s overall income tax slab.

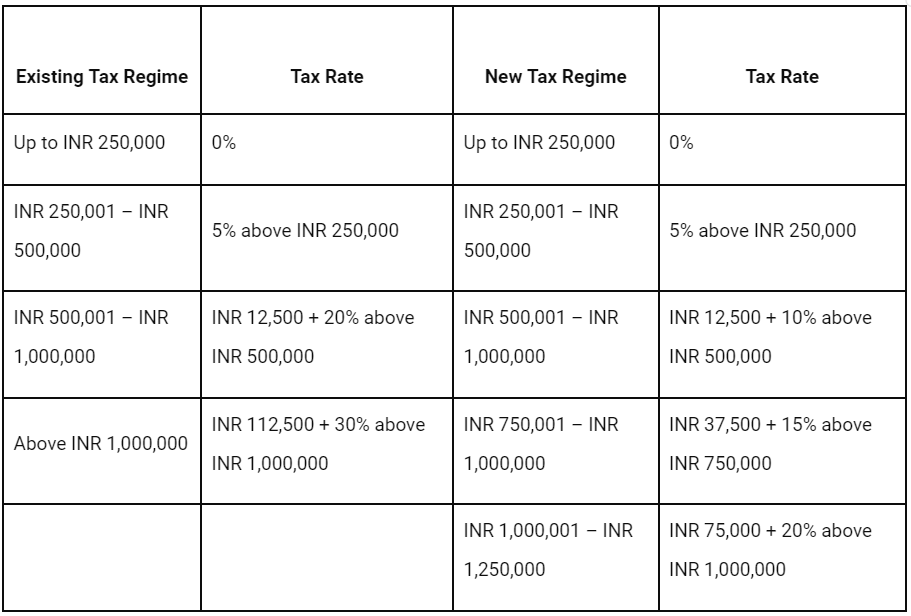

Individual Income Tax Slab Rates for FY 2022-23 (AY 2023-24):

Note: These rates apply to individual taxpayers below 60 years of age. The 30% crypto tax rate does not include applicable surcharge and 4% cess. Taxpayers with income up to INR 500,000 may be eligible for a rebate under Section 87A of up to INR 12,500.

Tax Calculation on Crypto as Salary:

When cryptocurrency is received as part of a salary package, it is taxed at a flat 30% rate, regardless of the individual's other income sources or applicable income tax slab. This taxation is in addition to the standard income tax rates and is calculated based on the fair market value of the cryptocurrency at the time it is received.

Example Scenario:

If an individual earns INR 500,000 in cryptocurrency as part of their salary, they will owe 30% tax on this amount, which equates to INR 150,000 plus applicable surcharges and cess. This is separate from the tax calculation on their other income sources.

Additional Considerations:

- TDS on Crypto Transactions: Starting July 1, 2022, a 1% Tax Deducted at Source (TDS) is applicable on cryptocurrency transactions exceeding certain thresholds. This TDS must be managed and filed by the individual, especially for transactions on foreign exchanges or P2P platforms.

- No Loss Set-Off: Losses from one type of cryptocurrency transaction cannot be offset against gains from another, nor against any other type of income. Each transaction must be reported separately for tax purposes.

This comprehensive approach ensures that all income from cryptocurrencies, including salaries, is adequately taxed, aligning with the broader regulatory framework for digital assets in India.

Taxes on Crypto Airdrops

In the cryptocurrency world, airdrops are similar to product samples given away by brands to gather feedback or enhance product visibility. For cryptocurrencies and NFTs, airdrops serve as a method to distribute new tokens directly to users' wallets, typically free of charge, to increase awareness and circulation during the initial launch phases.

Tax Treatment of Airdrops:

- Upon receipt, the fair market value of the airdropped cryptocurrency or token is considered taxable income under the "other incomes" category, as per Rule 11UA. This is based on the market value of the tokens on the day they are received, either on an exchange or decentralized exchange (DEX).

- If the recipient decides to hold, sell, exchange, or spend the tokens, any profits made from these transactions are subject to a 30% tax rate. This tax applies to the difference between the market value at the time of the airdrop and the price at the time of the subsequent transaction.

Example of Tax Calculation:

For instance, if you received 100 XYZ tokens on February 6, 2023, and the value of each token at the time of receipt was INR 10, the total taxable income would be INR 1,000. If these tokens increase in value and are later sold or exchanged, the profit earned from that transaction will also be taxed at the same 30% rate.

Additional Considerations:

- The tax on airdrops is calculated at the time of acquisition, and any subsequent increase in value is taxed as capital gains when the tokens are transferred.

- There is no tax implication for simply holding the airdropped tokens until they are sold or exchanged.

This framework ensures that all forms of income from virtual digital assets, including airdrops, are appropriately taxed, reflecting the broader aim of integrating cryptocurrency transactions within the Indian tax regime.

Tax Implications of Cryptocurrency Mining in India

Cryptocurrency mining involves supporting Bitcoin transactions and the blockchain network through powerful computers, a process that is pivotal for the integrity of blockchain operations. Participants in this activity, known as miners, play a crucial role in processing transactions and maintaining the blockchain.

Tax Treatment for Mining Activities:

- While the act of mining itself is not subject to direct taxation, any cryptocurrency earned through mining must be reported as taxable business income.

- Miners are taxed at a flat rate of 30% on the income derived from mined cryptocurrencies, such as when they sell, exchange, or spend the tokens they have mined.

- It's important to note that the cost basis for any cryptocurrencies acquired through mining is considered to be 'zero'. Therefore, the full amount received from selling these mined cryptocurrencies is taxable.

- Expenses incurred during mining activities, such as electricity costs or infrastructure, cannot be deducted from the taxable income.

Example Scenario:

If a miner sells 0.25 BTC that was mined and valued at INR 19,000 at the time of receipt, the entire amount from the sale is subject to a 30% tax, calculated based on the market value at the time it was received.

Additional Guidelines:

- The market value of mined cryptocurrencies at the time they are received (either on an exchange or a decentralized exchange) forms the basis for the calculation of the tax payable, as specified under Rule 11UA.

- Staying informed about the latest tax laws and ensuring compliance is crucial for miners to avoid potential penalties.

This taxation framework is designed to ensure that all financial benefits derived from cryptocurrency mining are appropriately taxed under Indian law, aligning with the broader objective of regulating the cryptocurrency market while recognizing the technological and economic contributions of miners.

Tax Implications on Cryptocurrency Gifts in India

In India, the receipt of cryptocurrency gifts falls under specific tax guidelines as outlined in the recent financial regulations. Cryptocurrencies, along with other non-fungible tokens (NFTs), are classified as Virtual Digital Assets (VDAs) and are considered movable assets under the Income Tax Act.

Tax Treatment for Cryptocurrency Gifts:

- Any cryptocurrency received as a gift valued over INR 50,000 from a non-family member is taxable. The recipient is responsible for paying income tax on the market value of the crypto assets received.

- Gifts from family members, or those received during special occasions such as inheritance, marriage, or as part of a will, are exempt from tax.

- For other crypto gifts not exempt by relationship or occasion, the income tax is levied at a flat rate of 30%, plus applicable surcharge and cess.

Example Scenario:

If a person receives Ethereum (ETH) worth INR 5,000 as a gift from a friend on July 5, this amount is added to their annual taxable income under the category of 'Other source income.' A 30% tax rate would then be applied to the INR 5,000, leading to a tax implication based on the recipient's total annual income.

Additional Considerations:

- It is important to document and report any crypto assets received as gifts for tax purposes.

- Understanding the value of the gift at the time of receipt is crucial, as this determines the tax liability.

These regulations ensure transparency and compliance with the tax obligations related to the transfer and receipt of cryptocurrencies as gifts, reflecting the broader objective of regulating the cryptocurrency market within India.

How to disclose Crypto Currency by Income Tax Return

To correctly file your taxes, it's essential to accurately report any profits derived from cryptocurrency transactions. These earnings can be categorized either as business income or capital gains, depending on the frequency of your trading activities and the nature of the transactions. Tax and consulting experts advise that such income should be declared in the 'VDA Schedule' of the ITR-2 or ITR-3 forms. It is important to note that the ITR-1 or ITR-4 forms are not suitable for reporting these types of income.

For taxpayers engaging in cryptocurrency transactions, understanding the distinctions between business income and capital gains is crucial. Business income might arise from high-frequency trading or other regular crypto-related business activities, whereas capital gains typically result from the occasional sale of assets held for investment purposes.

Additionally, ensuring all transactions are meticulously documented is key to providing accurate and compliant tax reports, aiding in the smooth processing of your tax returns.

Can You Avoid 30% Crypto Tax in India?

There is no lawful method to circumvent the 30% tax on cryptocurrency transactions in India. The penalties for tax evasion concerning cryptocurrencies are severe and proportionate to the gravity of the infraction. Here’s what you need to know about the penalties involved:

- Under-reporting or Misreporting Income: If you under-report or misreport your crypto-related income, you could face a penalty ranging from 50% to 200% of the tax evaded. More severe cases might also lead to imprisonment for up to 7 years.

- Late Filing of Income Tax Return: Not filing your income tax return within the prescribed deadline can attract various penalties. These include an interest charge of 1% per month on the unpaid tax and a late filing fee between INR 1,000 and INR 5,000. Severe delays might also result in a prison sentence of up to 7 years.

- Non-compliance with Tax Deducted at Source (TDS) Obligations: Failing to deduct or deposit the required TDS with the authorities can lead to interest charges and substantial fines for non-compliance.

- Failure to File a TDS Return: Not submitting a TDS return on time can incur a daily late fee of INR 200.

To navigate these stringent regulations, it is critical to adhere strictly to tax obligations. Timely and accurate reporting, along with diligent compliance with TDS requirements, will help you manage your crypto taxation affairs legally and responsibly, avoiding potential penalties.

G20 Updates on Crypto Regulations

During its G20 presidency, the Indian government prioritized discussions on the regulation of Virtual Digital Assets (VDAs), with a significant announcement from Prime Minister Narendra Modi at a G20 meeting highlighting the country's commitment to shaping global crypto regulations.

Key developments from the meeting included the advancement of the CryptoAsset Reporting Framework (CARF) and modifications to the Common Reporting Standard (CRS). The participating country leaders emphasized the need for transparency and coordinated international efforts in managing crypto assets. They tasked the Global Forum on Transparency and Exchange of Information for Tax Purposes with determining a suitable timeline for initiating exchanges between relevant jurisdictions.

A pivotal aspect of the discussions was the consensus that cryptocurrencies should not be recognized as legal tender. Additionally, the leaders acknowledged that imposing a ban on these digital assets could be counterproductive and challenging to enforce.

Prime Minister Modi underscored the transformative potential of crypto assets in redefining societal structures and impacting monetary and financial stability. He advocated for the creation of universal standards to effectively regulate and oversee the burgeoning sector, recognizing the importance of a coordinated global approach to address the complexities introduced by cryptocurrencies.

What Should Investors Do?

In light of the evolving Indian legislation on Virtual Digital Assets (VDAs), investors and traders must navigate the complexities of the new tax regime thoughtfully. As regulations are likely to be refined, staying informed and consulting with tax professionals is imperative before engaging in VDA transactions.

Key Recommendations for VDA Investors:

- Stay Informed: Continuously update yourself on the latest regulatory changes and government guidance regarding VDAs, including cryptocurrencies and NFTs.

- Consult Tax Advisors: Before initiating investments or trades, consult with a tax advisor to understand the implications of the current tax laws on your transactions.

- Utilize Recognized Exchanges: Trading on recognized exchanges or marketplaces is recommended over off-market transactions to help establish the fair market value of VDAs, ensuring compliance in the absence of clear government guidance.

- Track Expenses and Losses: Be aware that losses from one VDA cannot be set off against gains from another, and expenses related to the acquisition or creation of VDAs (like mining or minting costs) are not deductible from taxable gains.

- Regulatory Compliance: Ensure adherence to all tax obligations, including timely tax filing and compliance with TDS requirements, to avoid penalties.

Conclusion

Navigating the crypto taxation landscape in India requires a proactive approach to regulatory compliance. By understanding the tax rates, reporting requirements, and potential penalties, and by using tools and resources from platforms like CoinDCX for streamlined processes, investors can maintain transparency and legality in their crypto transactions. Keeping abreast of changes in tax laws is crucial for ensuring peace of mind and avoiding legal pitfalls in the dynamic world of virtual digital assets.