年齢別の純資産の平均と中央値:どのように比較しますか?

どれくらいあれば十分なのでしょうか? 個人のお金のこととなると、つい疑問に思うことがあります。「自分は同年代の人たちと比べて、うまくやっているのだろうか、それともうまくいっていないのだろうか?」年齢別の純資産を理解することは、強力な財務指標となります。

個人金融、富裕層の動向、デジタル決済を10年以上取材してきた金融ジャーナリストとして、私は数百もの金融レポートをレビューし、認定ファイナンシャルプランナーにインタビューを行い、Empower、NerdWallet、連邦準備制度などのプラットフォームから得られる行動データを分析してきました。このガイドは、重要なデータ、実例、専門家の洞察を凝縮し、誰もが自分の資産をベンチマークし、向上させるための実用的なロードマップとしてまとめています。

純資産とは何ですか?

純資産とは、あなたが所有するすべての資産の合計額から負債を差し引いたものです。これは、あなたの経済状況を示す最も正確な指標の一つです。年齢別の純資産計算ツールを使えば、全国平均と比較して自分の状況を推測することができます。

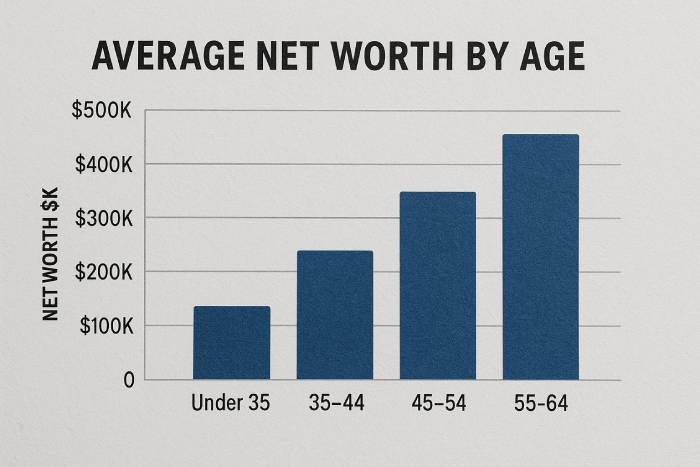

年齢別の平均純資産と中央値(2025年データ)

アメリカ人の平均純資産は、最も裕福な個人によって押し上げられる傾向があります。そのため、人口の中間点を反映し、世帯の富をより現実的に捉える中央値純資産も考慮しています。

連邦準備制度の2022年消費者金融調査の最新データに基づいて更新された、2025年時点の数字は次のとおりです。

年齢層 | 平均純資産(米ドル) | 平均純資産(米ドル) |

35歳未満 | 18万3500ドル | 3万9000ドル |

35~44 | 54万9600ドル | 135,600ドル |

45~54 | 97万5800ドル | 24万7200ドル |

55~64歳 | 1,566,900ドル | 364,500ドル |

65~74歳 | 1,794,600ドル | 40万9900ドル |

75歳以上 | 1,624,100ドル | 335,600ドル |

出典:連邦準備制度理事会、2023年10月発行

純資産の中央値と平均:なぜ重要なのか

多くの人が「アメリカ人の平均純資産はいくらですか?」と尋ねます。アメリカ人の平均純資産は、上位層の富が桁外れに高いため、アメリカの中央値よりもはるかに高くなっています。例えば、ほとんどの人がはるかに少ない資産しか持っていないにもかかわらず、数人の億万長者が平均を大幅に引き上げています。

ですから、 「自分の年齢の割に裕福だろうか?」と考えているなら、平均ではなく年齢別の純資産の中央値と比較する方が正確です。

年齢別の純資産比較:あなたはどのくらいですか?

この表は純資産の比較ツールとしてお使いいただけます。年齢別のシンプルな純資産計算ツールを使えば、年齢層やパーセンタイル内で自分がどの位置にいるのかを視覚的に把握できます。

人々はまたこう尋ねます:

- 年齢別に純資産額がどれくらいあれば健康的とみなされるのでしょうか?

- 30 歳または 50 歳の時点での純資産はいくらになっているでしょうか?

- 60歳の夫婦の平均純資産はいくらですか?

回答は、場所(カリフォルニア州の年齢別の平均純資産額と全国の数値など)、ライフスタイル、家族の規模、収入によって異なります。

年齢別平均世帯純資産

個々の数字に加え、年齢別の世帯純資産は、家族がどのように資産を築いてきたかをより広い視点から示します。夫婦や家族の場合は、年齢別の夫婦平均純資産や年齢別の家族純資産といったベンチマークの方がより適切かもしれません。

専門家の見解:ファイナンシャルアドバイザーの意見

金融の専門家は、年齢ごとに純資産を追跡することが長期的な財務健全性を構築する上で重要な部分であることに同意しています。

「純資産はあなたの財務スコアカードです。あなたのお金の習慣が成長につながっているのか、それとも停滞につながっているのかを理解する最も明確な方法です。」 –ポール・ディア、CFP® ( Empower )

「純資産を計算し始めると、お金に関するより賢い決断を下すためのツールとして、それがいかに強力であるかを実感します。」 –ローレン・シュワン、NerdWallet ( NerdWallet )

専門家の推奨:

- 6 か月ごとに純資産を追跡します。

- 高利債務の削減を優先する。

- 退職金口座を通じて継続的に投資する。

- 年齢別純資産計算機などの自動化ツールを使用して、時間の経過に伴う成長を監視します。

これらの推奨事項は、認定ファイナンシャルアドバイザーから得たものであり、長期資産蓄積と行動ファイナンスの研究によって裏付けられています。

実世界の使用事例と一般の人々からのフィードバック

実生活で人々が純資産ベンチマークをどのように使用しているかを以下に示します。

- テキサス州オースティン在住、32歳のマーカスさん:「年齢別の純資産計算ツールを使うことで、自分が30歳の平均純資産を上回っていることに気づきました。おかげで、より積極的に投資を始めようという自信がつきました。」

- ニュージャージー州在住のシングルマザー、ダナさん(45歳) :「自分の純資産を全国データと照らし合わせたら、同年代の純資産の中央値を下回っていることがわかりました。落ち込む代わりに、コーチと一緒に借金返済を早めることにしました。四半期ごとに記録することで、考え方が変わりました。」

- カリフォルニア州在住のアヴァとルイス(64歳) :「私たちは、年齢別の世帯純資産表を使って、夫婦としてどう暮らしているかを確認していました。それがゲームのようになって、今では半年ごとに一緒に座って数字を確認しています。」

💡試してみましょう:基準年齢(例:40歳、50歳、65歳)を選び、現在の純資産額を平均値と中央値と比較してみましょう。今後2年以内に1つ上の階層に上がるという目標を設定し、毎月進捗状況を追跡しましょう。

私の純資産はいくらであるべきでしょうか?

唯一の答えはありませんが、多くの金融専門家は次の公式を提案しています。

純資産目標= 年齢 × 年収 × 0.5~1.5 の係数

これにより、年齢ごとに純資産がいくらになるかの個別のベンチマークが得られます。

このフレームワークは、大手金融機関やアドバイザーによって、退職や早期の経済的自立などのマイルストーンを計画するための経験則計算としても使用されています。

アメリカの純資産動向

- 米国の平均純資産は増加し続けていますが、不平等は拡大しています。

- アメリカ人の純資産の中央値は、インフレ、住宅費、学生ローンなどの影響を受けて、ゆっくりと増加します。

- 年齢別の富は、教育、地域、人種によって大きく異なります。

これらの洞察は、ピュー・リサーチ・センター、米国国勢調査局、連邦準備制度理事会の経済レポートの調査結果と一致しています。

計算と比較に役立つツール

- 年齢別純資産チャート

- 純資産パーセンタイル計算機

- 年齢別の純資産目標

- 米国の年齢別純資産グラフ

これらのツールは、次のような質問に答えるのに役立ちます。

- 私の純資産はどう比較されますか?

- 年齢別の適正純資産額はいくらですか?

- 米国の年齢別の典型的な純資産はいくらですか?

この記事で参照されているすべての計算機とデータセットは、公開されている連邦政府データに基づいており、信頼できる金融機関によって検証されています。

最終的な考察: あなたは先を進んでいますか、それとも遅れていますか?

数字に落胆しないでください。むしろ、数字を戦略の指針としましょう。目標が年齢別純資産上位5%に入ることであろうと、単に安定した生活を築くことであろうと、進捗状況を追跡することが重要です。

年齢別の純資産額は単なる統計ではありません。それはあなたの経済成長の物語です。そして、その作者はあなた自身です。

ヒント:6~12ヶ月ごとに純資産額を見直しましょう。目標達成に向けて、価値を更新し、再計算しましょう。