Palantir Stock Price Prediction 2026-2030

Palantir Technologies Inc. (Palantir Technologies Inc) has become one of the most closely followed companies in the U.S. technology sector as of late 2025. With the stock trading near the upper range of its multi-year trajectory and investor interest intensifying around artificial intelligence, the question facing the market is how PLTR will perform through the end of 2025 and beyond.

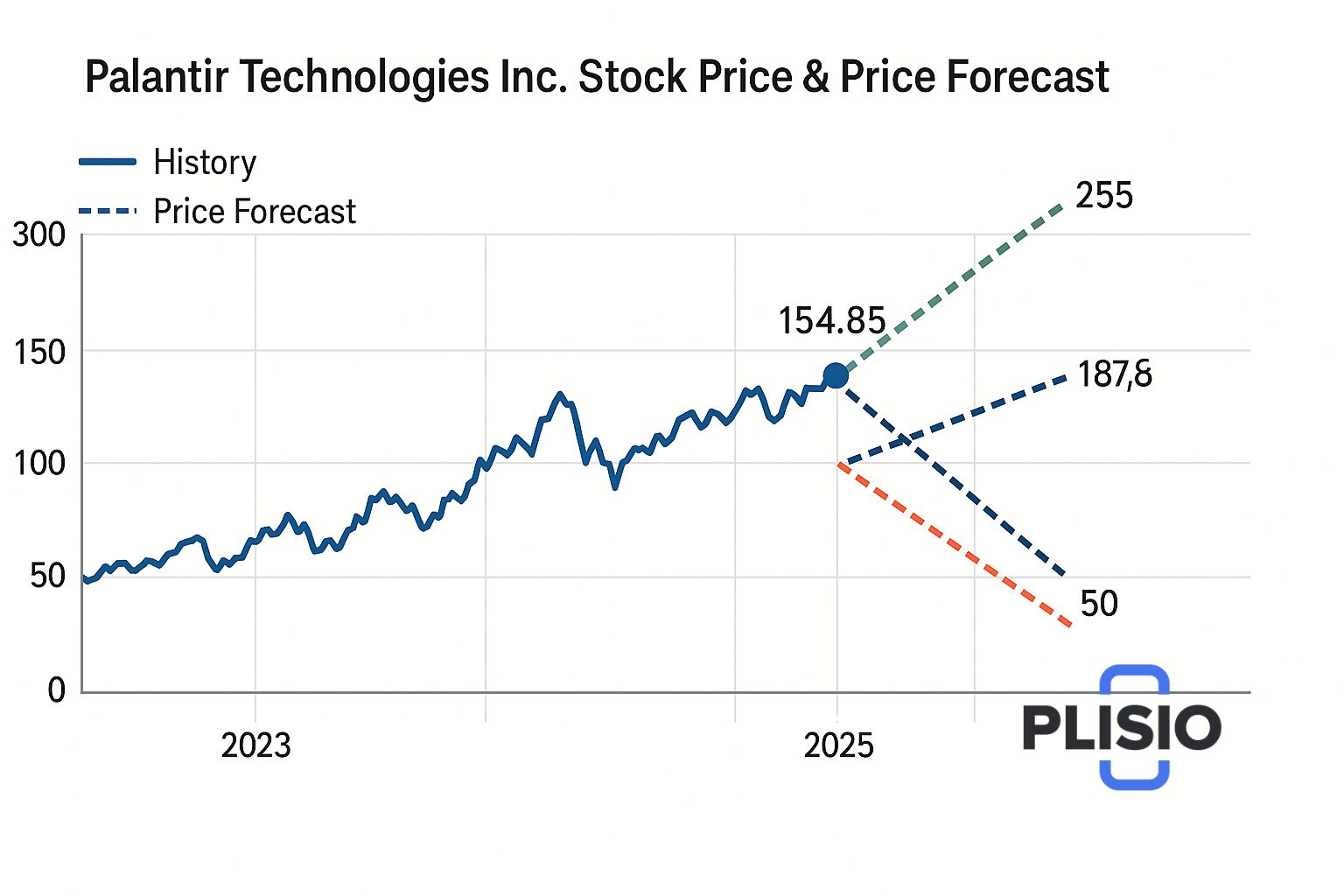

As of November 22, 2025, the current price of PLTR is $154.85, with an intraday range between $147.65 and $158.09 and substantial trading volume exceeding 71 million shares. The company’s market cap now sits in the $360–370 billion range, underscoring the scale of expectations already priced into the stock.

Palantir, headquartered in Denver, provides AI-powered software platforms that serve both government agencies and commercial enterprises. Its systems—Gotham, Foundry, and Apollo—enable central operating systems that support large-scale analytics, real-time operational decision-making, and integrated data pipelines. The company’s identity places it at the center of the artificial intelligence boom that continues to define the U.S. stock market on the Nasdaq exchange.

Palantir Stock Updated Financial and Operational Data

The company’s 2025 performance has exceeded expectations across most metrics.

Q3 2025 Highlights

|

Metric |

Value |

Context |

|

Total revenue |

$1.181B (+63% YoY) |

Exceptional growth across business lines |

|

U.S. commercial revenue |

+121% YoY |

Fastest-growing segment |

|

Full-year 2025 revenue guidance |

$4.398B (+53% YoY) |

Raised above earlier projections |

|

Operating margin |

Expanding |

Driven by scale efficiencies |

|

PLTR financials trend |

Strong earnings growth |

Sustained margin improvement |

The dramatic surge in the commercial segment has reshaped investor expectations. Government revenue continues to grow steadily, but private-sector adoption increasingly defines Palantir’s valuation narrative.

Key Business Drivers in 2025

1. AI-Powered Software Adoption

Enterprise adoption of artificial intelligence remains the dominant catalyst in 2025. Companies across financial services, supply chain, manufacturing, and healthcare rely on Palantir’s AI-software suite for automation, predictive analytics, and operational intelligence.

This shift has elevated Palantir from a niche government contractor into a foundational AI platform used across industries.

2. Commercial Segment Expansion

The commercial segment now demonstrates an annual growth rate exceeding 50%, outperforming nearly every major competitor in the data analytics and software-as-a-service category. The company’s foothold in U.S. financial services and manufacturing has become a major catalyst for revenue scaling.

3. Government Agency Demand

Government agencies remain a stable revenue pillar, particularly in defense, intelligence, and infrastructure modernization. Long-term contracts and mission-critical deployment continue to support dependable cash flow.

4. Market Sentiment and Trend Structure

The stock’s price action in 2025 has been dominated by AI-driven enthusiasm, occasionally interrupted by valuation-driven pullbacks. Price action this year has included several red candle sequences, but each has been met with buying pressure that reinforces long-term bullish momentum.

Palantir Stock Technical Analysis

Technical indicators as of November 22, 2025 show continued strength, though signs of overextension appear.

|

Indicator |

Value |

Interpretation |

|

RSI |

72 |

Overbought; potential short-term cooling |

|

50-day moving average |

$146 |

Price above MA indicates bullish momentum |

|

Lower trend support |

$138 |

Key downside level |

|

Price action |

Bullish overall |

Supported by higher highs and rising trend lines |

|

Short-term price |

Strong upward bias |

Reinforced by volume patterns |

While the overbought reading suggests near-term caution, long-term patterns remain undeniably bullish.

Analyst Assessments in 2025

Opinions on PLTR reflect a wide spectrum—from strong buy to strong sell—driven primarily by disagreements about valuation.

Updated Analyst Targets (2025)

|

Category |

Price Target |

Notes |

|

Bullish / strong buy |

$255.00 |

Assumes aggressive AI expansion |

|

Base-case target |

$187.87 |

Most consistent 2025 model |

|

Bearish / strong sell |

$50.00 |

Assumes valuation collapse |

|

Analyst price midpoint |

$172.14 |

A common conservative projection |

|

Price target for Palantir Technologies |

$187.87 |

Base-case scenario repeated |

|

Average price target represents |

Around $200 |

Market-weighted expectation |

These targets reflect a continued divide between valuation skeptics and AI-driven optimists.

Palantir Stock Updated Price Forecast for 2025

Taking into account 2025’s revenue acceleration, market sentiment, and valuation compression risk, the stock forecast is revised as follows.

Bullish Scenario

- AI demand strengthens further.

- Commercial revenue continues >50% YoY.

- Government contracts expand globally.

Target: $255.00 by end of 2025.

Base-Case Scenario (Most Likely)

- Revenue growth stabilizes at 35–45%.

- Margins continue expanding.

- AI adoption stays strong in private sector.

Target: $187.87 by end of 2025.

Bearish Scenario

- AI hype unwinds.

- Multiples contract.

- Negative forecast from weak macro or missed guidance.

Target: $50.00 in 2025–2026.

Forecast Summary

|

Scenario |

Target |

Probability |

|

Strong buy (bullish) |

$255.00 |

30% |

|

Base case |

$187.87 |

50% |

|

Strong sell (bearish) |

$50.00 |

20% |

Valuation in Late 2025

Palantir’s company’s valuation remains the center of debate.

|

Metric |

Value |

Notes |

|

Price-to-sales |

25–28x |

High for 2025 SaaS norms |

|

Forward P/E |

80–95x |

Reflects strong AI premium |

|

Market capitalization |

$360–370B |

Based on latest trading data |

|

Company’s valuation (analyst fair value) |

$135 |

Valuation lower than market price |

The disagreement surrounding the stock’s valuation is the primary reason why opinions oscillate between bullish enthusiasm and bearish caution.

Palantir Stock Long-Term Outlook Through 2030

The long-term view depends on whether Palantir solidifies its status as a global AI infrastructure provider.

2030 Projection

|

Year |

Revenue Forecast |

Expected Share Price |

Notes |

|

2030 |

$40–55B |

$300–450 |

High growth potential but dependent on adoption |

The next decade will determine whether Palantir becomes the dominant enterprise AI operating system or faces competitive pressures.

Conclusion (2025 Perspective)

Palantir’s 2025 story is defined by accelerating commercial adoption, strong earnings growth, and explosive interest in artificial intelligence. Investor debates center not on whether Palantir’s technology is impactful, but whether the stock’s valuation can be justified.

With the stock’s current price near $154.85, its future trajectory depends on execution, market sentiment, and the pace of AI adoption across industries.

The stock is expected to trend bullish into 2025 if current momentum continues, with a realistic price range between $187 and $255 depending on scenario. While risks remain, Palantir has become one of the defining companies of the AI era, and its stock’s future will likely reflect that position.