How to Short Bitcoin and Other Cryptocurrencies: A Beginner Guide

The cryptocurrency market is known for its high volatility, providing traders with opportunities to profit, even when prices decline. One popular strategy is short selling, which allows traders to capitalize on falling prices. By learning how to short Bitcoin and other cryptos, you can potentially profit during market downturns.

Shorting Bitcoin involves borrowing the asset, selling it at the current market price, and then buying it back later at a lower price. If the price drops as predicted, the trader can pocket the difference. This approach is often favored during bear markets or periods of uncertainty, making it a valuable tool in a trader’s arsenal when navigating the unpredictable crypto landscape.

What Is Crypto Shorting?

Crypto shorting, or short-selling, is a trading strategy that allows investors to profit from the decline in the price of cryptocurrencies. This process typically involves borrowing crypto assets from a broker, selling them at the current market price, and then repurchasing them at a lower price to return to the lender. The trader profits from the difference in price if the market moves in their favor, meaning the cryptocurrency depreciates as expected.

Although short-selling is traditionally associated with the stock market, it’s become a popular method for traders looking to benefit from the inherent volatility of cryptocurrencies like Bitcoin. Volatility in crypto markets provides opportunities to capitalize on price drops, which is why shorting has become a common strategy among experienced traders.

Beyond simply borrowing and selling cryptocurrencies, investors can also short cryptos through derivative contracts such as futures and options. These contracts allow traders to speculate on price movements without owning the actual asset, reducing the complexity of handling the crypto itself. Futures and contracts for difference (CFDs) are among the most widely used tools for shorting in the crypto space.

While shorting may seem like a straightforward way to profit from a declining market, it carries significant risk. If the asset’s price rises instead of falls, losses can be unlimited. As a result, short-selling is considered an advanced strategy, requiring a deep understanding of market behavior and effective risk management. Some traders also use shorting as a hedging technique to protect their portfolios from potential losses during market downturns.

Why Would You Short Crypto?

Shorting cryptocurrency can be an attractive strategy for traders who anticipate a decline in the market. There are several reasons why you might consider shorting cryptos:

- Potential for High Profits: The crypto market is known for its extreme volatility. This high-risk, high-reward environment appeals to traders looking for significant profit opportunities. If the market moves in the trader's favor, shorting can lead to amplified profits. However, it also carries the potential for substantial losses if the market moves in the opposite direction, so managing risk is crucial.

- Leverage with Margin Trading: Many online brokers offer margin trading, also known as leveraged trading, which allows you to borrow funds to increase the size of your position. With this, you only need to deposit a fraction of the total trade value. This can magnify both potential profits and risks, making it essential for traders to fully understand the mechanics of leverage and margin calls before engaging in such trades.

- Hedging Against Losses: Shorting can also be used as a hedging strategy to protect an existing long position. By opening a short position on the same or correlated asset, you can offset potential losses if the price of the asset declines. This strategy helps manage downside risk during times of market uncertainty or downturns, offering a way to safeguard your portfolio while still maintaining your overall investment strategy.

With more sophisticated trading platforms offering advanced tools like futures and options contracts, there are now a variety of ways to short cryptocurrencies. However, these strategies should be used cautiously, as they come with considerable risk and require thorough knowledge of market conditions and trading techniques.

How to Short Crypto

Shorting cryptocurrencies, such as Bitcoin, involves betting on the decline of their value, allowing traders to profit when prices fall. This strategy can be implemented in several ways, including margin trading, derivatives like futures and options, CFDs, and prediction markets. Let’s explore the most common methods for shorting cryptocurrencies and how to use them effectively.

Margin Trading

Margin trading is a common way to short cryptocurrencies. It allows traders to borrow funds from a broker or exchange, amplifying their position size and potential profits. For instance, if a trader has $200 in their account but wishes to short $1,200 worth of Bitcoin, they can borrow the remaining $1,000 on margin. The trader then sells the borrowed Bitcoin, expecting the price to drop, and buys it back at a lower price to repay the loan and pocket the difference.

However, margin trading also increases risk. Losses can exceed the initial investment if the market moves against the trader, as both gains and losses are magnified by leverage. Platforms like the Crypto.com Exchange offer margin trading for Bitcoin and other cryptos, allowing users to set stop-loss and take-profit levels to manage risk.

Derivatives Trading

Futures and options contracts are widely used to short Bitcoin and other cryptocurrencies. With futures, traders agree to sell or buy a cryptocurrency at a predetermined price on a specific future date. By selling a futures contract, they profit if the price falls before the settlement date. If the price rises, however, the trader could face significant losses.

Options, specifically put options, give traders the right (but not the obligation) to sell an asset at a set price before the contract expires. This allows for controlled risk, as the maximum loss is the premium paid for the option. Options are often used by experienced traders as part of more complex strategies.

In addition to traditional futures and options, newer products like UpDown Options and Strike Options simplify the trading process, allowing traders to predict price movements with limited downside risk. These products are ideal for traders who want clearly defined risk without using margin.

Using CFDs

CFDs allow traders to speculate on the price movements of cryptocurrencies without owning the underlying asset. When shorting with CFDs, traders profit if the asset’s value decreases between the time the contract is opened and closed. Unlike futures, CFDs don’t have a fixed expiry date, offering more flexibility for traders.

CFD trading can be highly profitable due to leverage, but it’s also risky, as traders can lose more than their initial investment. It’s essential to carefully manage risk by setting stop-loss orders and understanding the costs involved, including fees and interest on borrowed funds. CFDs are regulated in some markets, but in places like the United States, they remain illegal for crypto trading.

Prediction markets

Prediction markets allow traders to bet on the future performance of cryptocurrencies without holding any assets. For example, platforms like Gnosis and Polymarket let users bet on whether Ether or Bitcoin will decline by a specific amount. If the prediction is correct, the trader profits.

While this method doesn’t require direct investment in cryptocurrencies, it is considered a high-risk strategy. Prediction markets rely on forecasting future events, which can be uncertain, and the potential for losses is significant if the prediction is wrong. Traders should research thoroughly before using prediction markets for shorting.

Shorting cryptos with CFDs

When shorting cryptocurrencies using leveraged products like CFDs (Contracts for Difference), traders can speculate on the rise or fall of the asset's price without actually owning it. Leveraging allows a trader to open positions with a smaller deposit compared to the full value of the trade. However, leverage can significantly amplify both potential profits and losses, so caution is advised.

For instance, a 2:1 leverage ratio allows a trader to control a $1,000 position with only $500 of capital. If the trade moves in their favor, profits are magnified, but if the market goes against them, losses can quickly accumulate. Traders should ensure they are only trading amounts they are prepared to lose and employ risk management

Using futures or options

Options trading provides another flexible method to short cryptocurrencies. Traders can purchase put options, which give them the right to sell an asset at a predetermined price before the expiration date. This allows them to profit if the cryptocurrency’s price falls below the strike price.

Put options are a safer way to short compared to other methods, as the maximum loss is limited to the price (premium) paid for the option. However, profiting from options requires careful timing, as traders need to accurately predict both the price movement and the time frame within which it will occur. Options are often used as part of broader risk management strategies, such as hedging against potential losses in a long position.

In contrast, call options are used to profit from an increase in the asset’s value. While not typically used for shorting, some traders use both call and put options to cover all market scenarios.

Shorting with Exchange-Traded Funds (ETFs)

For those who prefer less direct exposure to the volatile crypto market, crypto ETFs can be used to short cryptocurrencies. Although crypto ETFs are relatively new, they offer a simplified way to short the market by tracking the performance of a specific cryptocurrency or a basket of assets.

Inverse crypto ETFs, in particular, are designed to rise in value when the price of the underlying cryptocurrency falls, making them a convenient tool for shorting. Traders can purchase shares of an inverse ETF instead of engaging in complex trading strategies like margin or derivatives.

Currently, Bitcoin and Ethereum ETFs are more common, but the number of available funds is expected to grow as the crypto market continues to evolve.

Example of Crypto Short-Selling

Let’s say Ether (ETH) is currently trading at $11.1285, and you anticipate that its price will drop. You decide to open a short position using a CFD (Contract for Difference) on 160 Ether CFDs. This allows you to profit from the expected decline without owning the actual cryptocurrency.

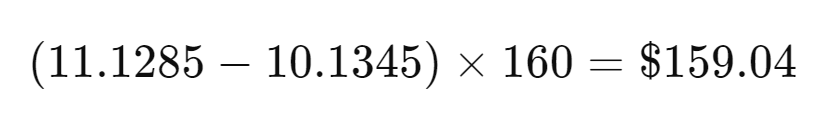

A couple of days later, the price of Ether drops to $10.1345, and you choose to close your position. Your profit would be calculated as follows:

In this case, you’ve made a profit of $159.04, not including any additional fees or costs associated with the trade, such as overnight financing or commissions.

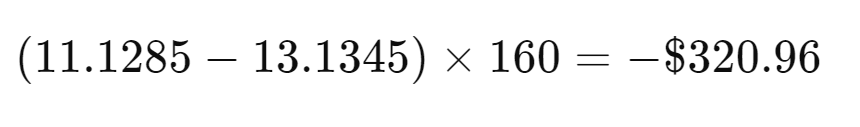

However, if the market moves against you and Ether’s price rises instead, you could incur a loss. For example, if the buy price increases to $13.1345, your loss would be:

This would result in a $320.96 loss, again excluding any additional costs.

When short-selling crypto, it’s important to account for potential fees, like overnight financing charges or commission fees, which can impact overall profitability. Traders should also monitor their positions closely and use risk management tools like stop-loss orders to minimize potential losses, especially in such a volatile market.

Long vs Short Position in Crypto

In the world of cryptocurrency trading, there’s a key difference between taking a long or short position. When you go long, you’re betting that the price of the cryptocurrency will rise. Conversely, when you go short, you’re speculating that the price will fall. Both strategies offer opportunities for profit, but they come with different levels of risk.

Long Position

A long position is taken when you expect the price of a cryptocurrency to increase over time. In this case, you buy the crypto with the intention of selling it later at a higher price. The profit is made when the value of the asset rises above your initial purchase price.

Example: You buy 1 Bitcoin at $20,000, anticipating that the price will rise. If the price increases to $25,000, you can sell it and make a profit of $5,000.

Risk: The maximum risk in a long position is limited, as the price of a cryptocurrency can never drop below zero. In the worst-case scenario, you lose the amount you originally invested.

Short Position

A short position is the opposite—you borrow the cryptocurrency and sell it at the current price, hoping the price will decrease. Later, you buy back the asset at a lower price, return it to the lender (or broker), and pocket the difference.

Example: You short 1 Ether at $2,000. If the price drops to $1,500, you buy it back, return the Ether, and make a profit of $500.

Risk: Shorting carries unlimited risk because the price of a cryptocurrency can theoretically increase indefinitely. If the market moves against you, and the price rises instead of falling, your losses can exceed the amount you initially shorted. For example, if the price of Ether rises from $2,000 to $3,000, your loss would be $1,000.

What Are The Rewards and Risks of Shorting Crypto?

Shorting cryptocurrencies offers both significant rewards and risks. For investors who correctly predict market movements, the potential for profit can be substantial. By using margin trading, traders can amplify their gains by borrowing funds, effectively increasing their position size without committing the full amount of capital upfront. This leverage can turn small price movements into large returns. Similarly, prediction markets offer opportunities for potentially unlimited profits, as long as the trader’s forecast is accurate.

Rewards of Shorting Crypto

- Amplified Profits Through Leverage: When using margin trading, traders can borrow funds to open larger positions than they could with their own capital. For example, if an investor opens a short position with $5,000 using a 2:1 leverage ratio, they control a $10,000 position. If the price drops as expected, the profit is based on the $10,000 position, not just the $5,000 investment, leading to greater potential returns.

- Hedging Against Portfolio Losses: Shorting can act as a hedging strategy to protect against potential losses in a cryptocurrency portfolio. For example, if you hold long positions in Bitcoin but expect a short-term downturn, opening a short position can balance your exposure and offset some of the losses from your long position.

- Profit in Bear Markets: One of the biggest advantages of shorting is that it allows traders to profit in declining markets. Unlike long-only strategies where profits depend on rising prices, shorting enables gains even when the overall market is bearish, providing more flexibility in various market conditions.

- Potential for Major Gains: If an investor accurately predicts the direction of a cryptocurrency’s price movement, they can secure significant profits. This can often lead to greater returns compared to simply buying and holding the asset, especially if the price falls sharply in a short period.

Risks of Shorting Crypto

- Unlimited Loss Potential: The most significant risk when shorting is the potential for unlimited losses. If the price of the cryptocurrency rises instead of falls, the trader must buy back the asset at the higher price to close the position, resulting in a loss. Since a crypto’s price can theoretically increase infinitely, the losses can exceed the initial investment. For example, if an investor shorts $5,000 worth of Bitcoin and the price surges by 50%, they would face a substantial loss, plus the cost of repaying the borrowed funds and any interest.

- Margin Call Risk: In margin trading, if the trade moves against the investor, the broker may issue a margin call, requiring the trader to add more funds to their account to maintain the position. If they are unable to meet this requirement, the broker may liquidate the position, resulting in significant losses. This can happen suddenly during highly volatile market movements, which are common in crypto markets.

- Borrowing Costs and Interest: When shorting on margin, traders must repay the borrowed funds along with interest. This can erode profits or increase losses, especially if the position is held for an extended period. Traders should carefully consider the borrowing costs when planning short-term vs. long-term trades.

- Missed Opportunities: Another key risk is the potential for missed profits. If a trader short-sells a cryptocurrency and its price begins to rise significantly, they may miss out on the opportunity to profit from that growth. Timing the market correctly is crucial, and if the investor exits too early or too late, they could lose the chance to capitalize on the rebound.

- Complexity of Prediction Markets: While prediction markets offer a way to hedge against potential losses, they are complex and require a deep understanding of both market dynamics and the underlying platforms. Traders who aren’t familiar with how these markets work may find it difficult to use them effectively, increasing the risk of making poor decisions.

Conclusion on How to Short Bitcoin and Other Cryptocurrencies

Shorting Bitcoin and other cryptocurrencies offers traders the opportunity to profit from declining prices, making it a valuable strategy in bear markets. Additionally, shorting is frequently used as a hedging tool to mitigate risk in highly volatile and unpredictable markets. However, due to the inherent risks, shorting requires a well-planned approach.

To successfully short Bitcoin or any other cryptocurrency, it’s essential to conduct comprehensive research and stay informed about market trends. Traders should closely analyze factors such as technical indicators, market sentiment, and macroeconomic developments that could impact cryptocurrency prices.

Equally important is the use of risk management strategies. This includes setting stop-loss orders, managing leverage carefully, and keeping a close watch on margin requirements to avoid sudden liquidations. Shorting can lead to significant losses if the market moves against you, so constant monitoring of open positions is crucial.

For traders who are just starting out or are less experienced with shorting, it’s advisable to practice on demo accounts or start with smaller positions to build confidence before taking on larger trades.

Overall, while shorting can be a powerful tool for generating profits or hedging during market downturns, it requires a solid understanding of the crypto market and disciplined risk management to navigate its complexities effectively