Palladium Price Prediction: Outlook for 2026–2030

The palladium market has entered the final weeks of 2025 with a mix of volatility, renewed industrial demand, and ongoing uncertainty around global supply. As a precious metal with strong industrial utility—especially in catalytic converters—palladium remains deeply sensitive to changes in automotive production, geopolitical tensions, substitution trends involving platinum, and broader financial markets. This updated analysis reflects the most current price today, incorporates historical data, and offers a comprehensive palladium price prediction for 2026 through 2030.

Palladium Price Overview and Forecast

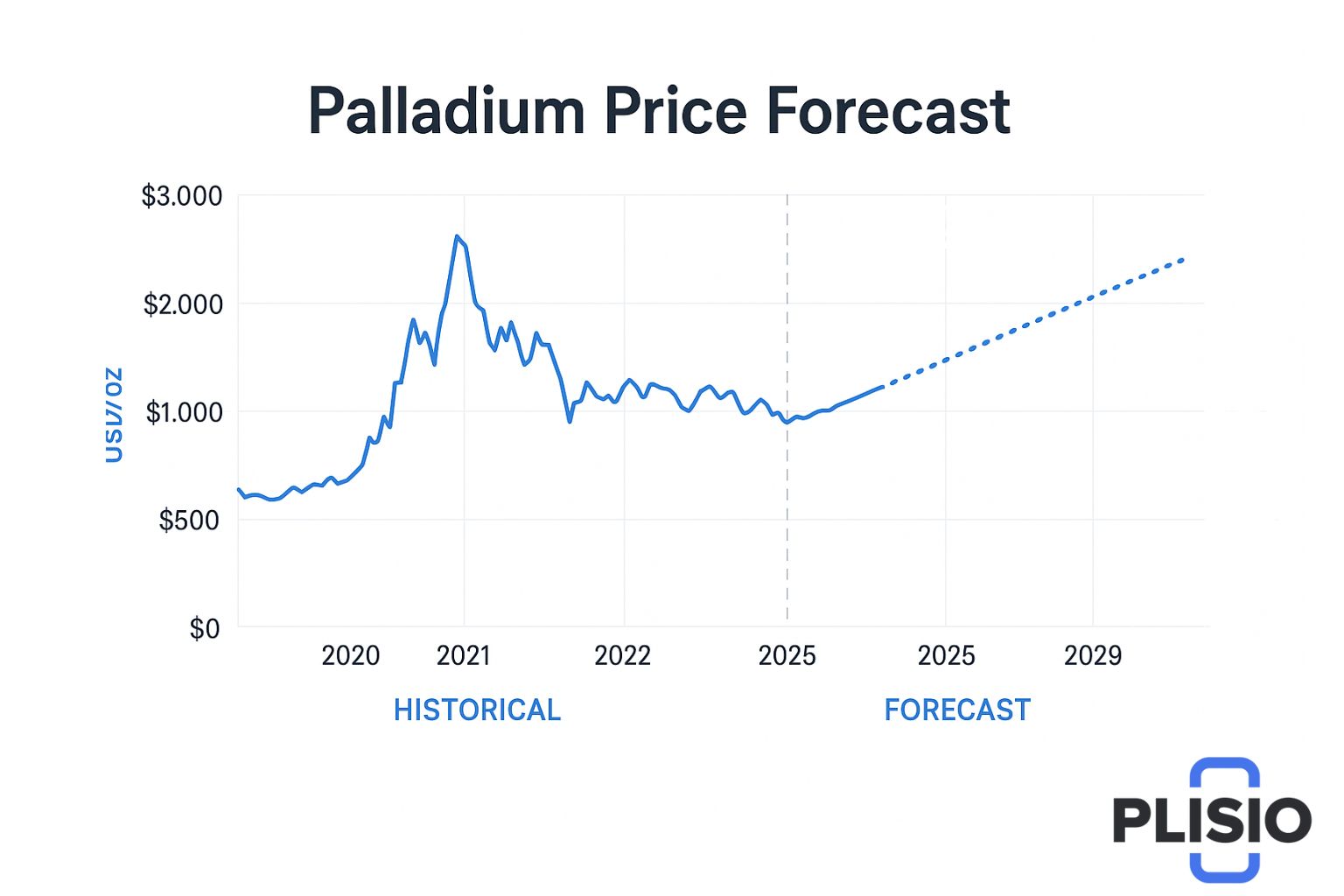

As of the end of 2025, the palladium price sits near $1,470–$1,500 per troy ounce, reflecting moderate recovery from early-year lows. While well below its all-time high, palladium's price trend shows stabilization supported by constrained mining supply and steady demand from the auto sector. The LBMA benchmark and major data provider platforms confirm that year-to-date levels have shown a noticeable rebound, though still overshadowed by the metal's dramatic 2022–2023 slides.

Palladium's price today is shaped by several intersecting forces: reduced Russian output, fluctuating recycling flows, and evolving risk appetite across global financial markets. Market trends also show that institutional investors remain cautious but increasingly attentive to palladium’s role as both an industrial necessity and a potential hedge under shifting monetary policy environments.

|

Metric |

Value (End of 2025) |

|

Spot price per troy ounce |

$1,470–$1,500 |

|

Year-to-date performance |

+40–45% recovery |

|

Key demand source |

Catalytic converters (ICE & hybrid vehicles) |

|

Notable market driver |

Declining primary mining supply |

Palladium's price trend at the end of December reflects global conditions including geopolitical tensions, EV adoption rates, and substitution dynamics involving platinum and palladium in emissions-control technologies.

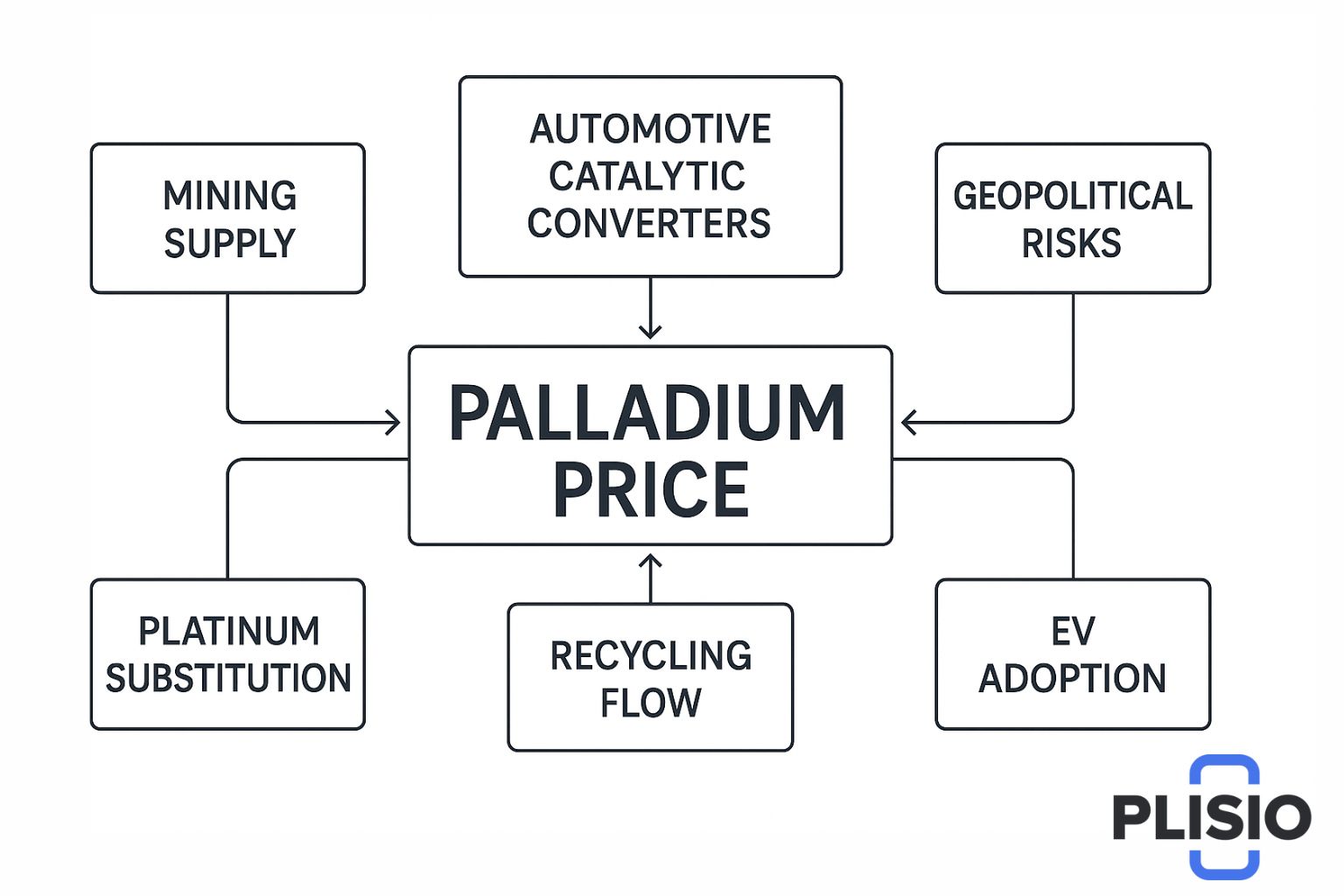

Palladium Price Fundamental Drivers

The price of palladium continues to depend heavily on the auto industry. Demand from the auto sector represents more than three-quarters of global usage, driven by its unique ability to support cleaner emissions through catalytic converters. While electric vehicles are expanding worldwide, hybrid and internal combustion engine cars still dominate many markets, sustaining palladium demand.

Several deep structural factors influence the price forecast:

- Mining supply constraints: Russia and South Africa continue to experience operational variability, contributing to tight global supply. Mining supply remains one of the top drivers for long-term projections.

- Geopolitical uncertainty: Global tensions periodically disrupt shipments, influence investor sentiment, and affect the bullion market.

- Substitution with platinum: Automakers evaluate platinum as a lower-cost alternative. However, substitution remains slow, preserving palladium demand.

- Recycling flows: Higher metal price per ounce stimulates recycling, increasing secondary supply. This moderates extreme price spikes but cannot replace primary production.

- Electric vehicles: Growing EV market share reduces future demand, but hybrid vehicles create ongoing palladium usage over the next decade.

A look at historical data reveals that palladium’s price behavior has always been highly responsive to the balance of these forces. Even small disruptions can trigger strong bullish moves, especially when supply deficits emerge.

Palladium Price Forecast Through 2025

Since 2025 is ending, the relevant view focuses on the final price at the end of 2025 and possible closing dynamics into December 2025. Analysts polled across several platforms, including Trading Economics, expect the price at the end of December to stay within its current band unless sudden geopolitical or supply shocks occur.

|

Period |

Expected Range (per troy ounce) |

|

End of 2025 |

$1,500–$1,650 |

|

December 2025 (final trading weeks) |

$1,520–$1,680 |

This price forecast for 2025 aligns with the broader view that palladium could stabilize during year-end conditions. A bullish setup would require an unexpected tightening in the bullion market or sharply rising automotive production.

Palladium Price Forecast for 2026–2030

2026 Outlook

The 2026 price forecast projects palladium trading in the range of $1,520–$1,850 per troy ounce. This assumes:

- modest recovery in hybrid production,

- steady inflation expectations,

- and limited substitution with platinum.

A bullish case in 2026 could lift prices toward the upper boundary if mining supply contracts more sharply than expected.

2027 Outlook

For 2027, palladium’s price prediction places values between $1,600–$1,900. Market trends suggest that tighter supply from South Africa and Russia may coincide with stable global auto-sector demand. Any geopolitical escalation would expand this range.

2028 Outlook

Predictions for 2028 indicate a potential rise to $1,650–$2,050, especially if recycling rates remain stable and demand from the auto sector grows in developing regions. Palladium futures positioning also reinforces the possibility of increased speculative interest.

2029 Outlook

The 2029 forecast estimates a trading band of $1,700–$2,150 per ounce. By this time, EV adoption will influence demand more sharply, reducing reliance on catalytic converters. However, hybrid vehicles—still a major global segment—may delay steep declines.

2030 Outlook

By 2030, forecasts place palladium in the $1,750–$2,300 range. The future path depends largely on:

- the speed of global EV penetration,

- regulatory shifts affecting emissions standards,

- and the degree of platinum substitution.

Long-term models projecting as far as 2040 suggest that palladium will not disappear from industrial applications but will face gradual demand recalibration.

Additional Market Scenarios

- Base case: Sustained hybrid demand, moderate EV growth, stable recycling output, and no major supply disruptions. Prices remain within forecast ranges.

- Bullish scenario: Stronger global automotive output, tightening mine supply, and increased speculative interest push palladium above $2,000 before 2028.

- Bearish scenario: Rapid EV expansion and sharp substitution with platinum drive prices below $1,400 by late 2027.

Near-Term Market Interpretation

Near-term price news highlights ongoing discussions about mining production risks, Russian output uncertainty, and macroeconomic data shaping investor behavior. Monetary policy decisions will continue shaping risk appetite into early 2026.

Palladium remains intertwined with the broader precious metal space, including gold and silver. However, its industrial utility gives it a uniquely sensitive position within global financial markets.

Investment Considerations

For diversified investors, palladium serves as both an industrial metal and a hedge. CFDs (CFD instruments) and physical bullion are common exposure routes. While high volatility creates risks, it also provides opportunities during phases of supply tightness.

Platinum and palladium comparisons remain central for industrial buyers. Although platinum is often cheaper, performance characteristics ensure palladium retains its critical role in key automotive applications.

Summary

At the end of 2025, palladium stands at a transitional moment. Its price trend reflects both legacy demand and future transformation. Forecasted palladium values through 2030 suggest moderate growth supported by constrained mining supply and stable hybrid vehicle markets. The average price will vary based on geopolitical shifts, recycling expansion, changes in global risk appetite, and the ongoing evolution of the auto industry.

The price of palladium entering 2026 is shaped by a blend of historical data, present conditions in the bullion market, and forward-looking structural factors. In the near-term and long-term future, palladium’s outlook remains defined by complexity—and opportunity.