Polygon (MATIC / POL) Price Prediction:2026, 2030, 2040 and 2050 Outlook

The polygon ecosystem remains one of the most important infrastructure layers in the modern crypto market. Originally known as matic, the project has evolved from a single scaling layer into a multi‑chain blockchain ecosystem under the Polygon 2.0 architecture. Today, investors closely monitor polygon price prediction models to understand the future price potential of this major digital asset.

As of 2026, the cryptocurrency market continues to recover from previous volatility cycles. Many analysts consider the current phase transitional, where short‑term bearish pressure coexists with long‑term bullish potential. Because polygon operates as a scaling solution for the ethereum blockchain, its success is often directly linked to ethereum adoption, overall crypto market liquidity, and total market growth.

Understanding polygon price predictions requires examining technical analysis, historical price data, tokenomics changes, and macro trends affecting cryptocurrencies.

Overview of Polygon Network and Technology

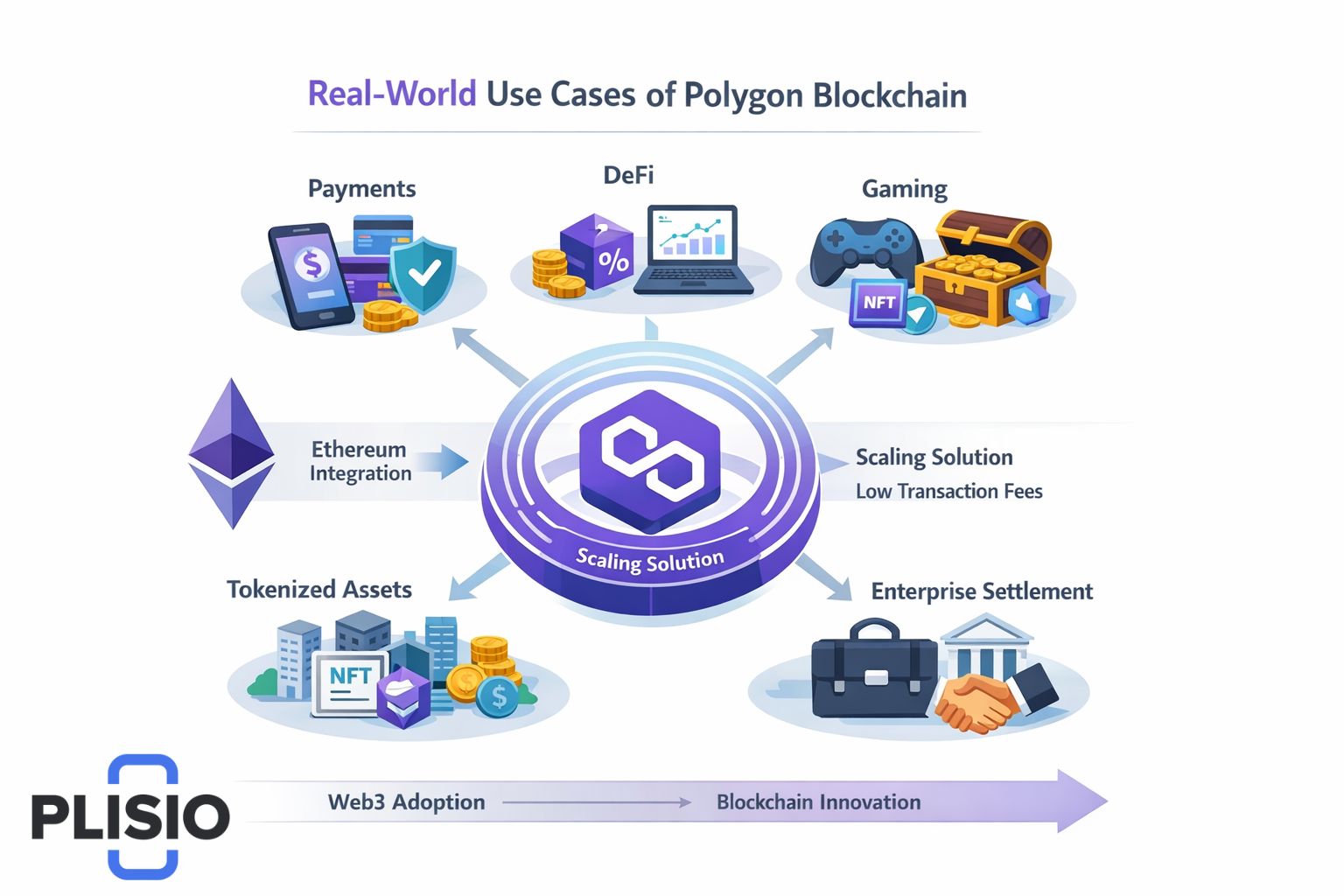

The polygon network is designed as a scaling solution for ethereum. The main goal is reducing transaction fees, improving throughput, and enabling faster settlement while maintaining security inherited from the ethereum blockchain. This scaling model allows developers to deploy decentralized applications while avoiding congestion that traditionally impacts the ethereum network.

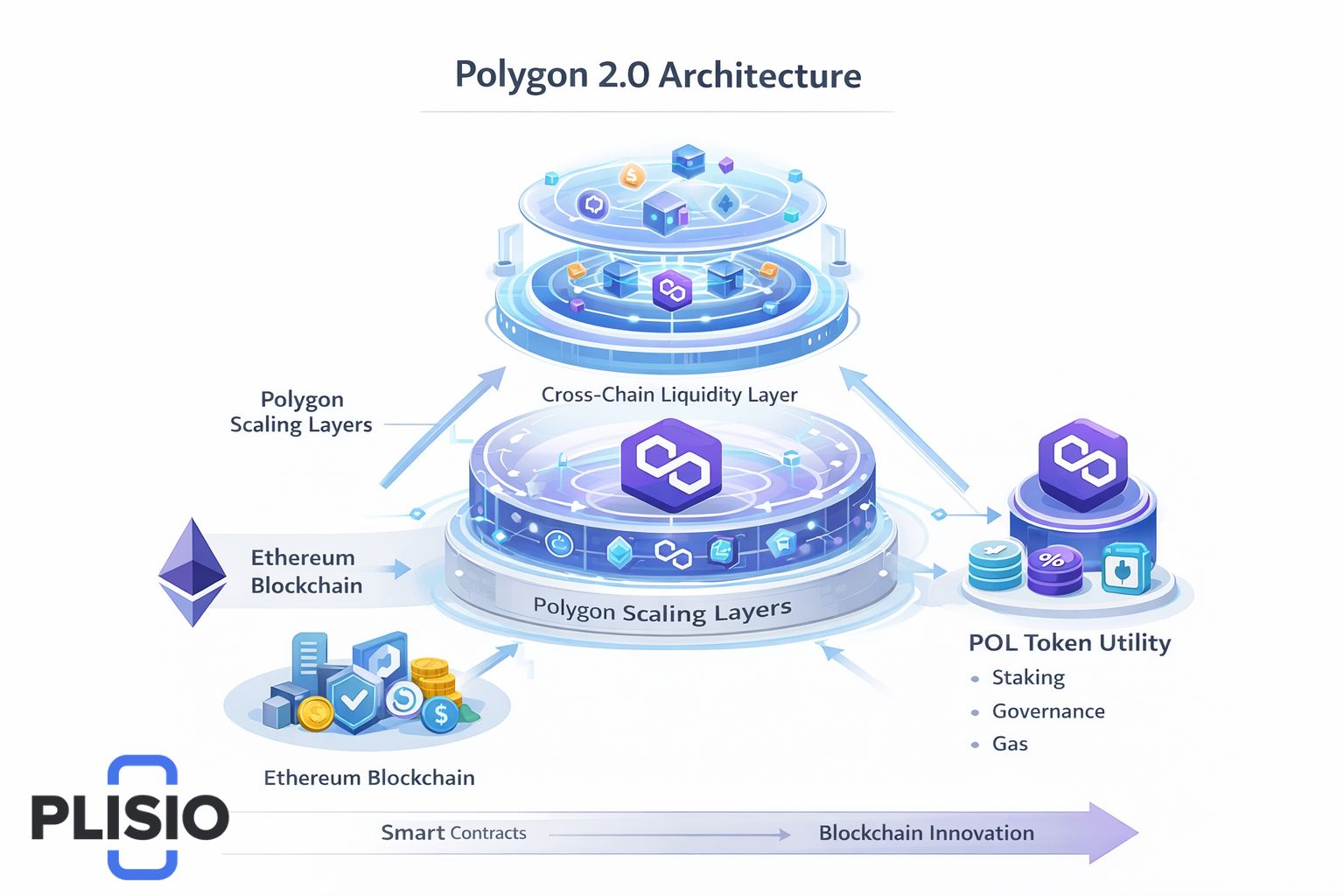

Polygon uses multiple technologies including proof‑of‑stake chains, zero‑knowledge scaling approaches, and cross‑chain interoperability layers. The transition from the matic token to POL represents a major infrastructure redesign. The shift from matic to pol started in 2024 and is still shaping long‑term token economics.

The native token POL now functions across governance, staking, cross‑chain validation, and network security. Many analysts believe pol tokens could become one of the core utility assets inside the multi‑chain polygon 2.0 ecosystem.

The project remains among top cryptocurrency by market cap rankings and continues to hold strong market capitalization compared to many infrastructure competitors.

Current Price Situation and Market Sentiment in 2026

The current price environment reflects global macro pressure and slower capital inflow into the cryptocurrency market. The live price fluctuates depending on liquidity cycles, institutional flows, and risk sentiment across the crypto market.

Recent price analysis shows mixed indicator signals. Some technical indicator metrics show oversold conditions, while others still reflect bearish momentum. Market sentiment remains cautious but not negative enough to invalidate long‑term growth scenarios.

The price of polygon is influenced by several key forces including:

- Ethereum ecosystem expansion

- Adoption of polygon network infrastructure

- Institutional demand for scalable blockchain infrastructure

- Growth of Web3 use case deployments

Despite short‑term price movements, long‑term price predictions often depend on network usage metrics rather than speculation.

Historical Price Performance and Market Cycles

Understanding historical price movements helps create realistic polygon price forecast models. The polygon coin price saw major expansion during 2021, when altcoins surged across the crypto market.

|

Period |

Historical Price Context |

Market Condition |

|

2021 |

Rapid expansion during global bull run |

Strong bullish |

|

December 2021 |

Peak speculative demand across altcoins |

Extreme bullish |

|

2024 |

Beginning of matic to pol migration |

Mixed |

|

2026 |

Post‑migration consolidation |

Neutral to bearish |

The price history of the matic coin reflects typical infrastructure token behavior. The asset tends to move strongly during liquidity expansion phases and consolidate during risk‑off macro cycles.

Polygon Price Prediction Table (2026 to 2050)

|

Year |

Minimum Price |

Average Price |

Potential Bullish Price |

|

price prediction 2026 |

$0.18 |

$0.38 |

$1.20 |

|

2027 |

$0.25 |

$0.45 |

$1.40 |

|

price prediction 2028 |

$0.30 |

$0.55 |

$1.80 |

|

price prediction 2030 |

$0.25 |

$0.85 |

$4.50 |

|

price prediction 2040 |

$0.70 |

$2.50 |

$8.00 |

|

price prediction 2050 |

$0.97 |

$5.00 |

$12.00 |

These numbers represent aggregated polygon prediction scenarios based on historical price trends, technical analysis modeling, and projected adoption curves.

Polygon Price Prediction 2026

The price prediction 2026 scenario suggests moderate recovery potential. Most models estimate minimum price near $0.18 and average price around $0.38.

The polygon price prediction depends heavily on cryptocurrency market recovery, ethereum scaling demand, and enterprise adoption. If crypto price momentum improves, polygon’s price could reach $1 during bullish phases.

The price of matic historically correlates with ethereum usage growth and total market liquidity cycles.

MATIC Price Prediction and POL Transition Impact

The matic price prediction narrative has changed due to the transition to POL. The matic token historically functioned as the core gas and staking asset. The new architecture distributes validation roles across pol tokens.

The pol price and pol price prediction now represent long‑term valuation metrics for the polygon network. The transition creates new token supply models and potential deflation mechanisms.

The matic crypto identity still influences branding, and many investors continue using matic coin terminology despite technical migration.

Polygon Price Prediction for 2030

The polygon price prediction for 2030 remains one of the most searched price predictions in the crypto sector. The prediction 2030 scenario ranges widely.

Most analysts estimate:

Minimum price near $0.25 Average price around $0.85 Bull run potential between $3 and $4.50

The price prediction 2030 assumes increased Web3 adoption, growth of blockchain enterprise usage, and continued expansion of scaling infrastructure.

Long Term Price Prediction 2040 and 2050

Long‑term price prediction 2040 and price prediction 2050 models are highly speculative but useful for long‑term investors.

Future price projections depend on:

Global adoption of decentralized infrastructure Enterprise blockchain settlement adoption Tokenization of real world assets

The polygon price prediction models show possible multi‑dollar valuations if adoption accelerates.

Technical Analysis Overview

Technical analysis helps forecast short‑term price movements. Analysts typically evaluate price chart structure, support levels, and trading volume trends.

Current technical analysis indicators show mixed signals. Some metrics indicate bearish continuation risk, while others suggest potential reversal zones.

Price analysis suggests strong historical price support near previous cycle lows.

Market Position and Market Capitalization

Polygon remains one of the leading cryptocurrency by market cap infrastructure assets. Strong market cap positioning supports liquidity and investor confidence.

The cryptocurrency by market rankings often show polygon competing directly with other scaling networks. The market capitalization stability helps reduce extreme volatility compared to smaller altcoins.

Comparison With Other Crypto Forecast Models

Investors often compare polygon price prediction models with xrp price prediction or other infrastructure token forecasts. These comparisons highlight similarities in liquidity cycle behavior.

The cryptocurrency price of infrastructure tokens typically follows network adoption rather than hype cycles.

Investment Perspective: Is Polygon a Good Investment?

Many investors ask if polygon a good investment. The answer depends on timeframe and risk tolerance.

Polygon offers strong use case diversity including payments, DeFi infrastructure, and enterprise blockchain solutions. Because of its role as a scaling solution for the ethereum blockchain, long‑term demand may remain strong.

However, competition and macro crypto market cycles remain risk factors.

Polygon 2.0 and Future Ecosystem Expansion

Polygon 2.0 introduces multi‑chain architecture designed to unify liquidity across chains. This design may increase network adoption and token utility.

The transition from matic to pol represents one of the largest token infrastructure upgrades in modern blockchain architecture.

Long Term Polygon Price Forecast Outlook

The polygon price forecast depends primarily on adoption metrics rather than speculation. The polygon coin price will likely track usage growth across decentralized applications and enterprise infrastructure.

The future price outlook suggests moderate steady growth if the cryptocurrency market continues expanding globally.

Final Conclusion

Polygon remains one of the most important infrastructure projects in crypto. The evolution from matic token to POL represents a major technological and economic shift.

Short term price prediction for polygon suggests volatility and consolidation. Long term polygon price prediction models remain positive if adoption continues expanding.

For investors researching buy polygon or buy matic strategies, the key metric is network usage growth rather than short term price movements.

Polygon continues to position itself as core infrastructure inside the ethereum ecosystem. If the polygon network becomes a major settlement layer for global decentralized applications, long‑term realistic price targets could significantly exceed current price levels.

The price of polygon, like most cryptocurrencies, will ultimately follow adoption, liquidity cycles, and technological relevance inside the global cryptocurrency market.