Avalanche (AVAX) Price Prediction 2026-2040

Avalanche is one of the most discussed layer-1 blockchains in the modern cryptocurrency market. Its native token, avax, is widely traded across major exchanges and plays a central role in network security, governance, and transaction processing. This article presents a detailed avalanche price prediction with updated analysis for 2026 and beyond, based on historical data, technical context, and ecosystem development. The goal is to provide a clear, research-driven overview of where the price of avalanche and the price of avax may go under different market conditions.

Avalanche was founded by cornell university professor Emin Gün Sirer. More precisely, it was developed under the leadership of cornell university professor emin gün and university professor emin gün sirer, whose academic background in distributed systems strongly influenced Avalanche’s architecture and security model. Today, Avalanche’s network supports DeFi platforms, NFT marketplaces, and enterprise applications while competing with other smart-contract platforms such as ethereum.

Key Takeaways

- AVAX remains a core asset in the evolving crypto market.

- The average avax price in 2026 will depend on global liquidity and DeFi growth.

- Long-term forecasts such as the price prediction 2030, price prediction 2040, and price prediction 2050 are speculative but highlight Avalanche’s potential.

- The token’s value is closely tied to adoption, staking participation, and broader market conditions.

Avalanche Network Overview

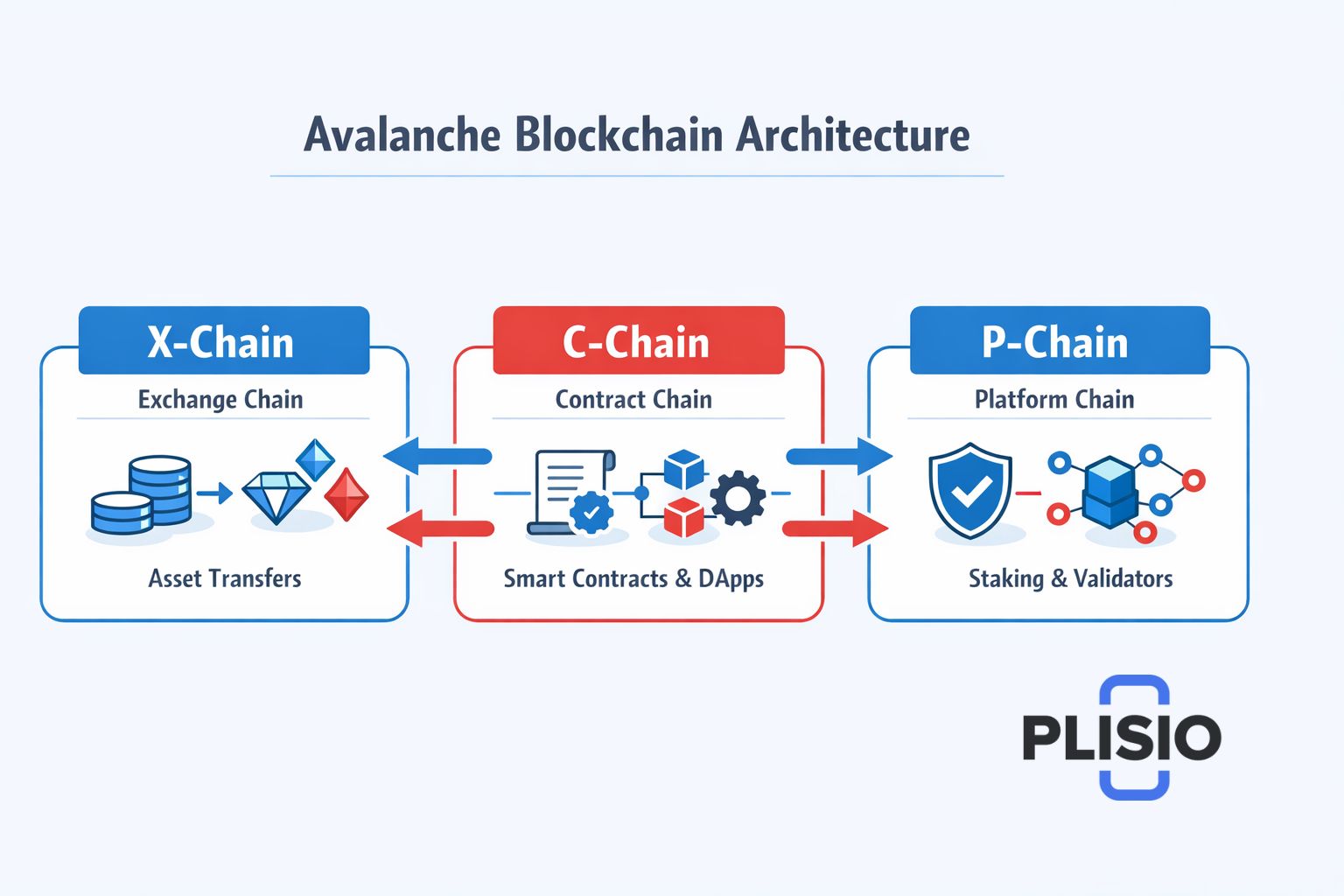

Avalanche is a high-performance blockchain platform designed for speed, decentralization, and flexibility. Unlike many single-chain systems, the Avalanche network is built around three integrated blockchains, often referred to as specialized chains:

- X-Chain (exchange chain) for asset creation and transfers

- C-Chain (contract chain) for smart contract execution using the Avalanche Virtual Machine

- P-Chain (platform chain) for validator coordination and subnet management

Together, these chains allow Avalanche to handle complex decentralized applications while keeping transaction fees relatively low. The system relies on the avalanche consensus mechanism, which enables rapid finality and high throughput without sacrificing decentralization. The avalanche virtual machine ensures compatibility with Ethereum tools, making migration easier for developers building dapps and DeFi services.

Avalanche also supports staking through staking avax, allowing participants to act as a validator or delegate their tokens to validators in exchange for rewards. This staking model directly ties the native token to network security and long-term value.

Historical Performance and Market Behavior

Understanding historical price behavior is essential when forming any price prediction. The price history of AVAX shows extreme growth cycles followed by deep corrections. During the 2021 bull market, AVAX surged to an all-time high above $140, driven by expanding DeFi adoption and overall bullish conditions across the crypto market.

Later, macroeconomic tightening and risk-off sentiment pushed prices lower. The price chart shows strong correlation with bitcoin and ethereum, confirming that AVAX often follows broader market price trends. This pattern demonstrates that price movements are shaped not only by Avalanche-specific development but also by the overall cryptocurrency price environment.

By 2024, the token entered a consolidation phase, reflecting weaker liquidity and cautious investors. In 2024, AVAX traded within a wide range, reflecting both optimism about long-term growth and fear caused by global market pressure.

Current Market Conditions

As of today, the live price of AVAX reflects a stabilized but uncertain phase. The current market shows moderate trading volume, and the market cap places Avalanche among the top blockchain platforms globally. Analysts observe mixed market sentiment, with both accumulation and profit-taking behavior visible on major exchanges.

On-chain indicators such as wallet activity, staking participation, and transaction counts suggest steady usage of the Avalanche ecosystem. On-chain metrics show that despite reduced speculation, net-work fundamentals remain intact.

Avalanche Price Drivers

Several factors influence the avalanche price and future forecast:

- Growth of decentralized finance and DeFi protocols using Avalanche

- Expansion of the avalanche ecosystem with new tools and partnerships

- Integration of subnets for institutional use

- Correlation with bitcoin and ethereum market cycles

- Regulatory clarity across major economies

Avalanche also benefits from interoperability and the rise of multi-chain strategies. The system of blockchains within Avalanche allows developers to build customized environments while remaining connected to the main network.

AVAX Price Prediction 2026

The price prediction 2026 depends heavily on whether the next crypto cycle becomes bullish or remains neutral. Many models expect AVAX to recover gradually as liquidity improves.

AVAX Price Prediction 2026

|

Scenario |

Minimum |

Maximum |

Average |

|

Bearish |

$10 |

$18 |

$14 |

|

Neutral |

$18 |

$30 |

$24 |

|

Bullish |

$30 |

$55 |

$42 |

This table represents a general average price range under different market conditions. Under optimistic assumptions, avax is expected to benefit from renewed DeFi interest and higher staking demand.

Investors asking whether to buy in 2026 must evaluate their risk tolerance. While avax may rebound strongly in a bullish cycle, downside risks remain if macro pressure persists.

AVAX Price Prediction 2027

By 2027, long-term adoption trends may play a stronger role. Analysts expect the avalanche forecast for 2027 to depend on the scale of enterprise adoption and subnet usage. If institutional adoption increases, the avax token could see sustained demand.

Forecast range for 2027:

|

Scenario |

Estimated Price |

|

Bearish |

$15 – $25 |

|

Neutral |

$25 – $40 |

|

Bullish |

$40 – $80 |

Avalanche Price Prediction 2030

The price prediction 2030 reflects long-term optimism about blockchain infrastructure. By 2030, decentralized applications may become part of mainstream digital services.

Price Prediction 2030

|

Market State |

Projection |

|

Conservative |

$80 – $120 |

|

Growth Case |

$120 – $250 |

|

Aggressive |

$250 – $400 |

Under favorable scenarios, a million avax locked in staking could represent substantial value. However, competition from other platforms means success is not guaranteed.

Avalanche Price Prediction 2040

The price prediction 2040 is highly speculative. If Avalanche becomes a dominant settlement layer for financial infrastructure, the price of avalanche could reach levels far above current values.

Possible 2040 outlook:

|

Scenario |

Expected Value |

|

Low Case |

$200 – $400 |

|

Mid Case |

$400 – $800 |

|

High Case |

$800 – $1,200 |

Price Prediction 2050

The price prediction 2050 depends on whether blockchain becomes as critical as the internet itself. In a future where decentralized systems dominate, avax could become a key infrastructure asset. In such a scenario, long-term holders may see exponential growth, but this outcome remains theoretical.

Bullish vs Bearish Outlook

Bullish factors:

- Growth in DeFi and avalanche markets

- Expansion of subnets and enterprise adoption

- Strong developer community

Bearish factors:

- Regulatory pressure

- Market volatility and oversell cycles

- Competition from newer blockchains

The token is considered highly volatile, meaning rapid price changes can occur in short time frames. Therefore, AVAX remains suitable primarily for investors with higher risk tolerance.

Should You Buy Avalanche?

Whether to buy avalanche depends on personal strategy. AVAX is widely used as gas for smart contract execution and for securing the network via staking. The coin is often described as a long-term infrastructure bet rather than a short-term speculative asset.

Investors evaluating the avax price prediction should consider both technical indicators and fundamental development within the avalanche network. While avax is considered a strong competitor to Ethereum in terms of speed and fees, Ethereum’s network effect remains significant.

Additional Metrics and Indicators

Key metrics often used in forecasting include:

- Market cap relative to competing chains

- Developer activity across dapps

- Staking ratio and number of active validator nodes

- Transaction throughput and transaction fees

These metrics help estimate long-term price action and adoption trends.

Avalanche vs Other Blockchains

Avalanche also differentiates itself through interoperability and subnet architecture. Compared with other blockchains, it provides faster settlement times and flexible deployment models. This gives Avalanche an edge in financial applications and gaming platforms.

The system’s exchange chain, contract chain, and platform chain form a modular environment that reduces congestion and improves scalability. This structural advantage supports the long-term avalanche prediction model.

Final Thoughts

Based on its current market structure and development trajectory, AVAX remains one of the most promising infrastructure tokens in the blockchain space. Based on its current market, analysts suggest that AVAX may experience renewed interest if macro conditions improve and if DeFi usage rebounds.

The coin may continue to fluctuate in the short term, but its long-term relevance depends on sustained innovation within the Avalanche ecosystem. As adoption grows, coin may benefit from network effects and increased utility.

In conclusion, while the future remains uncertain, Avalanche also stands out as a technologically advanced network with real-world use cases. For investors willing to accept risk, AVAX represents exposure to next-generation blockchain infrastructure including avax within diversified crypto portfolios.