Tempus AI Stock Price Prediction 2026-2027

Tempus AI Inc is an ai-driven healthcare technology company that sits at the crossroads of medicine, data science, and artificial intelligence. The company was founded in 2015 and is headquartered in Chicago, positioning itself as a critical infrastructure provider for precision medicine. Tempus AI provides advanced diagnostics, data analytics, and software solutions to healthcare providers, research institutions, and pharmaceutical companies. Its platforms integrate molecular data, clinical records, and real‑world evidence to support oncology, cardiology, radiology, and broader therapeutic decision‑making.

This article delivers a comprehensive Tempus AI stock price prediction, combining the latest Tempus AI market data, consensus analyst rating trends, analyst price target predictions, and long‑term financial forecast models. The goal is not hype, but clarity: how analysts currently see the Tempus AI stock (ticker TEM) evolving into 2026 and 2027, and what that means for a long‑term investor.

Company Background and Business Model

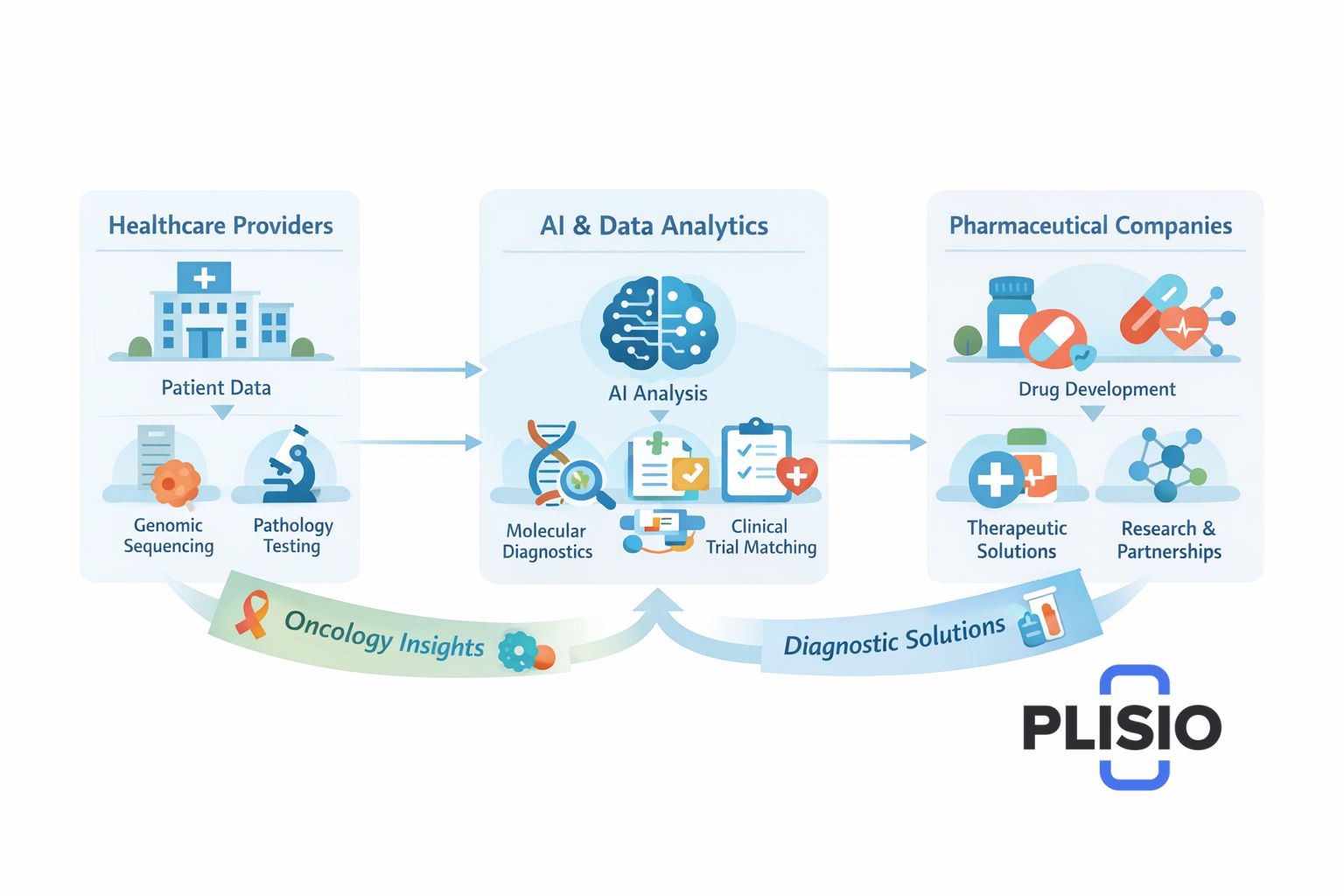

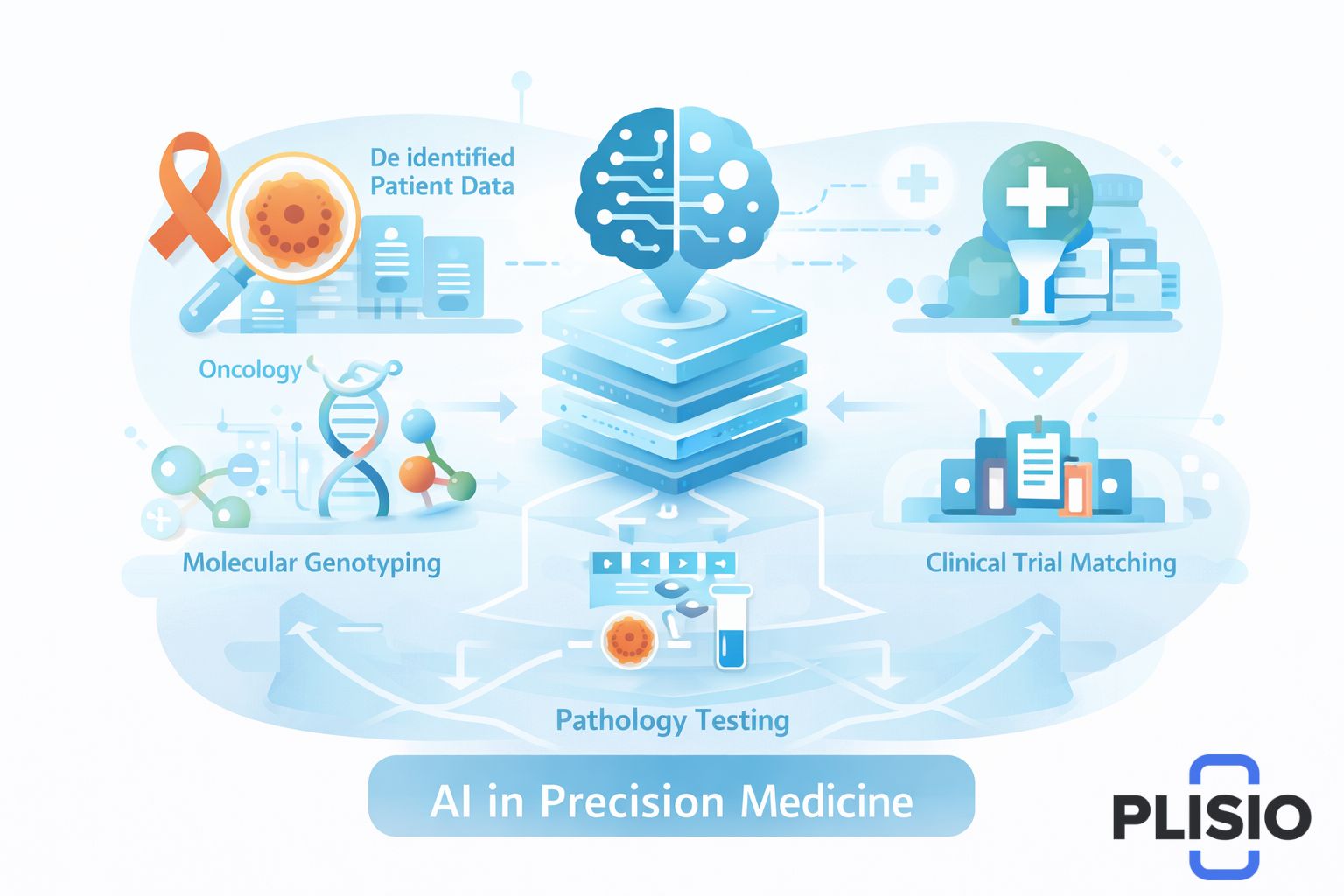

Tempus AI Inc operates a vertically integrated healthcare data ecosystem. Its core capabilities include sequencing diagnostics, molecular genotyping, and pathology testing, all enhanced by large‑scale machine learning. The company also provides clinical trial matching services, allowing physicians to connect patients with relevant therapeutic studies using de‑identified genomic and clinical data.

Tempus AI’s technology stack spans multiple medical disciplines. In addition to oncology, where it remains strongest, the company is expanding into cardiology and radiology, leveraging AI models trained on multimodal datasets. These datasets are protected by proprietary intellectual property and long‑term data agreements, which analysts often cite as a defensive moat in the healthcare AI sector.

A major differentiator is Tempus AI’s collaboration strategy. Through strategic partnerships with global drug developers such as AstraZeneca, the firm embeds its analytics directly into pharmaceutical R&D pipelines. The acquisition of Ambry Genetics strengthened its position in hereditary cancer testing and expanded its commercial reach.

Tempus AI Stock Overview and Market Position

The TEM stock represents ownership in a rapidly scaling healthcare platform rather than a mature cash‑generating utility. As a result, the stock in the past has shown higher volatility compared with traditional healthcare names. From 2023 through the past 3 months, price action has been driven largely by earnings reports, guidance updates, and broader sentiment toward AI‑focused equities.

At present, the current price of Tempus AI common stock trades below the highs reached shortly after its public debut, reflecting a recalibration of growth expectations across the AI sector. Still, the market capitalization remains substantial, signaling continued institutional interest and confidence in the company’s long‑term relevance.

For traders and long‑term holders alike, the stock quote has become a focal point for debates around valuation versus growth optionality.

Analyst Coverage, Ratings, and Consensus View

Wall Street coverage of Tempus AI has expanded steadily. Today, 12 analysts actively publish research on the company. Their collective consensus rating sits between Buy and Hold, reflecting optimism about the business model balanced against near‑term profitability risks.

The distribution of opinions includes buy ratings, several hold rating assessments, and at least one strong sell view that focuses on valuation and cash burn. Importantly, there are also strong buy calls from analysts who believe Tempus AI’s data scale and partnerships justify a premium multiple.

The overall rating for Tempus AI can be summarized as cautiously constructive rather than euphoric. This nuanced stance is typical for growth‑stage healthcare technology companies.

Analyst Price Targets and Stock Forecast Data

The most discussed metric among investors is the price target for Tempus AI. Analysts publish both individual and aggregate projections, often referred to as analyst price targets.

|

Metric |

Value |

|

Number of analysts |

12 analysts |

|

Average price target |

Approximately $86–$88 |

|

High analyst price |

Around $105 |

|

Low target |

Around $76 |

|

12-month price expectation |

Moderate upside |

The average price target represents the midpoint of bullish and conservative assumptions. In plain terms, the average price target for Tempus implies upside from the current price, but not without risk.

These analyst price target predictions form the backbone of most public stock forecast models and are frequently referenced by platforms such as Zacks and other research aggregators.

Tempus AI Stock Price Prediction for 2026 and 2027

For investors looking for concrete numbers rather than abstract ranges, analysts now publish specific stock price prediction figures for Tempus AI stock based on discounted cash flow models, peer valuation, and revenue scaling assumptions.

As of today, the current price of TEM common stock is assumed at $69.00 for forecasting purposes. From this baseline, the following numeric projections are most frequently cited in sell-side research.

|

Year |

Scenario |

Stock Price Prediction |

|

2026 |

Bear case |

$72.00 |

|

2026 |

Base case |

$85.00 |

|

2026 |

Bull case |

$105.00 |

|

2027 |

Conservative |

$90.00 |

|

2027 |

Optimistic |

$115.00 |

In the 2026 base case, analysts expect the stock price to reach approximately $85, aligning closely with the published average price target. This scenario assumes continued double-digit revenue growth, improving operating leverage, and no major dilution events.

The bull case price target for Tempus AI of $105 reflects aggressive adoption of AI-driven diagnostics, deeper penetration into pharmaceutical workflows, and stronger-than-expected margins. Conversely, the bear case of $72 assumes slower enterprise adoption and persistent losses.

Looking further ahead, 2027 projections extend higher, with several models placing the TEM stock near $90 in conservative scenarios and up to $115 if Tempus AI successfully converts scale into sustainable profitability.

These figures are the numeric backbone behind most published stock forecast tables and explain why the average price target represents moderate but not speculative upside from today’s valuation.

Earnings, EPS, and Financial Health

From a financial standpoint, earnings remain negative on a GAAP basis, which is not unusual for a company investing heavily in data infrastructure and R&D. Analysts track EPS trends closely, particularly adjusted EPS, to assess operational discipline.

Recent reports show improving revenue and EPS trajectories, even if absolute profitability is still ahead. The company’s balance sheet is generally viewed as adequate, though continued monitoring of liquidity and financing needs is essential for security‑minded investors.

Trading Dynamics and Short‑Term Considerations

Short‑term trading in TEM stock is influenced by technical levels, news flow, and sector rotation. Momentum indicators occasionally flash bullish signals, but volatility remains elevated.

For active traders, the key is understanding that Tempus AI is not a defensive healthcare play. It behaves more like a hybrid of biotech and software, which explains the sharp reactions to earnings and guidance updates.

Risks, Valuation, and Insider Activity

From a valuation perspective, Tempus AI trades at a premium to traditional diagnostics firms but in line with high‑growth AI platforms. Analysts remain divided on whether this premium is fully justified today or only in a longer‑term horizon.

Additional factors include reported insider sales, which have occasionally weighed on sentiment, even when fundamentals remained intact. These transactions do not necessarily signal weakness, but they are incorporated into risk models.

Key Factors Shaping the Forecast

- Expansion of AI‑driven diagnostics and therapeutic analytics

- Deepening relationships with pharmaceutical companies

- Protection of proprietary data and intellectual property

- Execution risk tied to scaling operations efficiently

These variables underpin most forecast data used in institutional models.

Final Outlook and Recommendation

The prevailing recommendation among analysts is neither overly aggressive nor dismissive. Tempus AI Inc is widely viewed as a strategically important player in precision medicine, with long‑term upside tied to data scale and AI adoption.

The stock price prediction consensus suggests moderate appreciation potential over the next 12‑month price window, with additional optionality into 2026 and 2027 if execution remains strong. For a patient investor, Tempus AI stock offers exposure to a unique intersection of healthcare, data, and artificial intelligence, albeit with above‑average risk.

As always, forecasts are probabilities, not certainties. Tempus AI’s future will ultimately be shaped by its ability to translate data into durable clinical and commercial value.