Netflix Stock Price Prediction 2026-2030

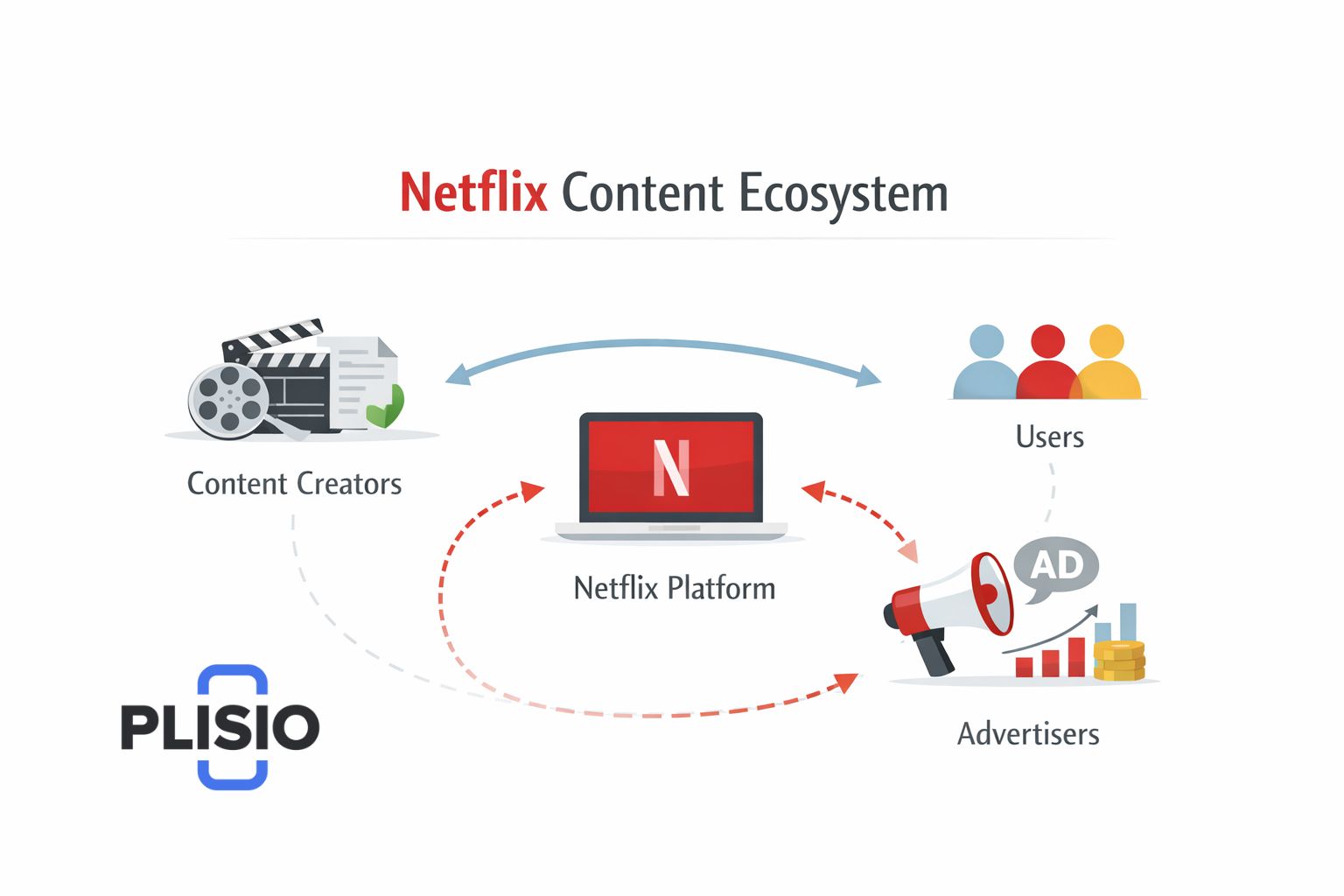

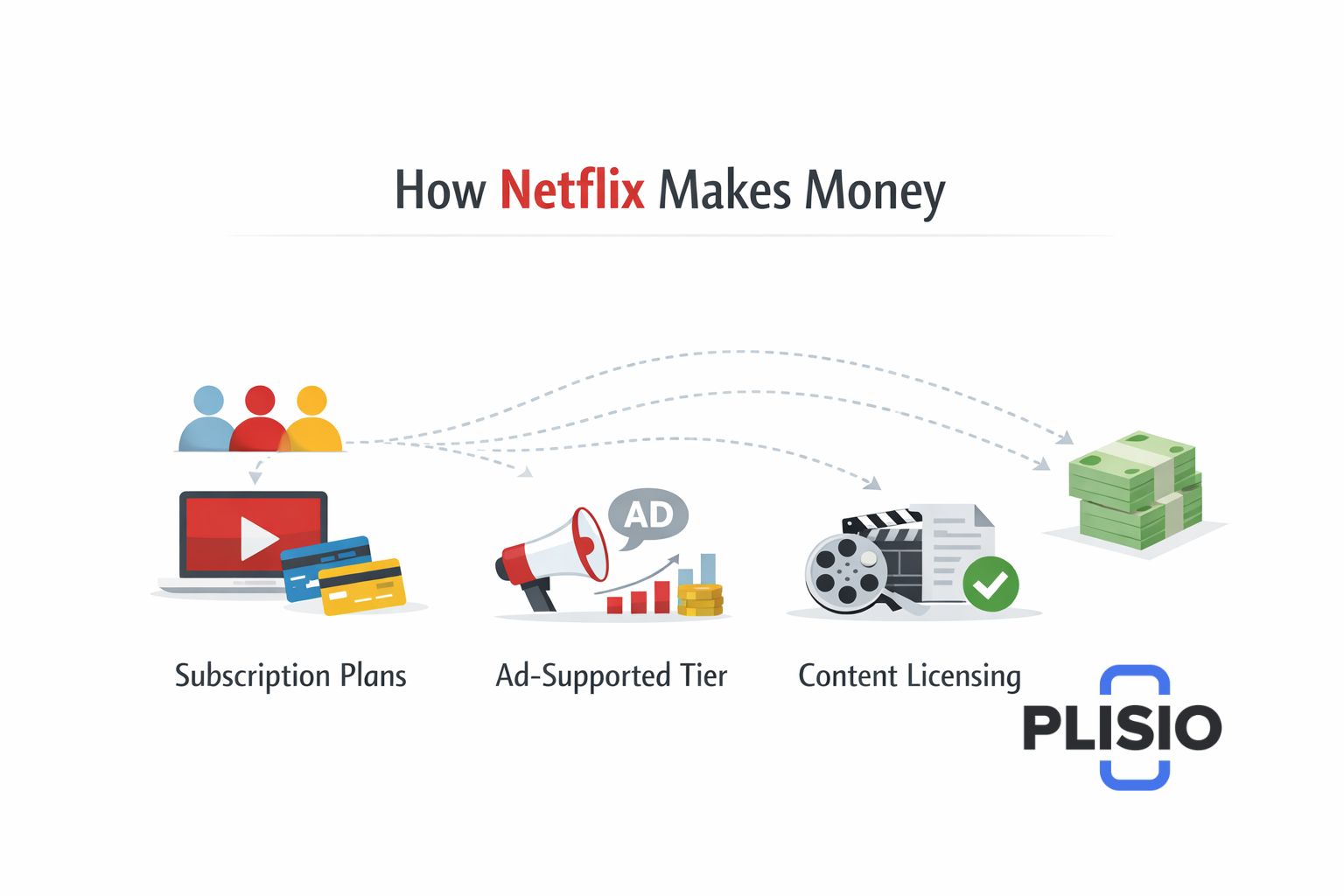

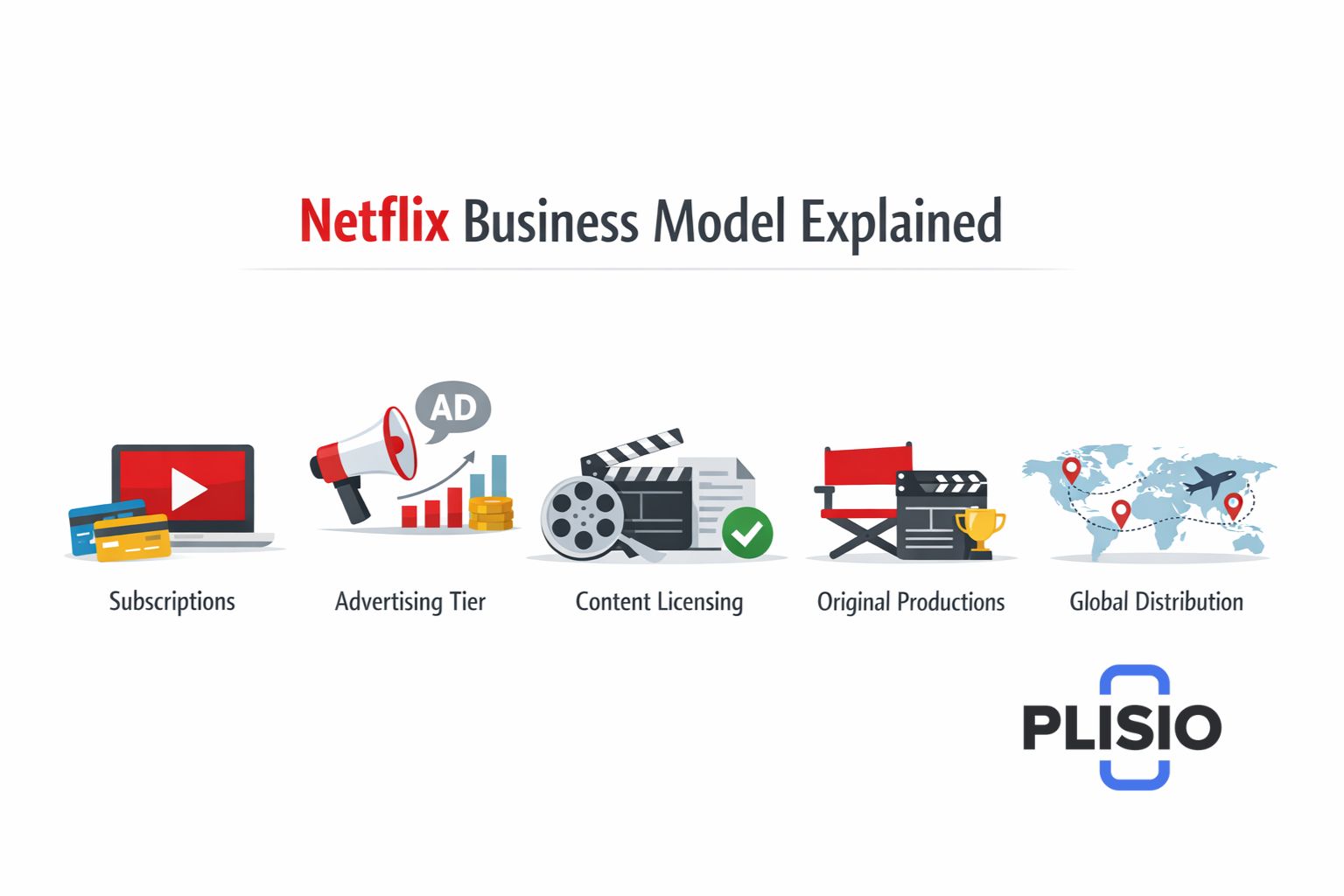

In 2026, the discussion around netflix stock price prediction has fully entered a mature, data-driven phase. Netflix Inc, the global streaming giant and one of the most influential media companies of the last two decades, is no longer judged solely on subscriber growth. Instead, investors focus on profitability, advertising efficiency, disciplined content spending, and long-term valuation sustainability.

Netflix, traded under the ticker NFLX on the NASDAQ, remains a core component of global equity portfolios, major ETFs, and the S&P 500. The company was founded by Marc Randolph, together with Marc Randolph and Wilmot Reed Hastings, often referenced historically as Randolph and Wilmot Reed Hastings. This origin story still matters to the investment community, as it reflects a culture of experimentation combined with long-term strategic thinking.

This article delivers a fully updated netflix stock forecast for 2026, supported by analyst price target predictions, concrete numerical scenarios, technical analysis, valuation models, and a long-range financial forecast extending to 2030. All data and assumptions reflect the current market environment in 2026.

Latest Netflix Stock Price and Real-Time Market News

Investors looking to find the latest netflix information rely on real-time market feeds, earnings releases, and institutional research notes. As of early 2026, the netflix stock price is trading in a relatively stable range, reflecting confidence in Netflix’s cash-generating ability.

- Current nflx stock price: approximately $625 per share

- Exchange: NASDAQ (not NYSE)

- Approximate market cap: $275–285 billion

This stock price level places Netflix firmly in the large-cap category and ensures high liquidity. Ongoing market news related to advertising growth, international expansion, and content licensing continues to shape short-term price action.

Analyst Rating for Netflix and Consensus Rating in 2026

The analyst rating picture for netflix in 2026 reflects cautious optimism. Coverage remains broad, with more than 30 firms actively publishing research. Aggregated platforms such as TipRanks show that the overall consensus rating is Moderate Buy.

Analyst Rating Breakdown

|

Rating Category |

Share of Analysts |

|

Strong Buy |

~35% |

|

Buy / Outperform |

~40% |

|

Hold |

~20% |

|

Sell |

~4% |

|

Strong Sell |

~1% |

This rating for netflix highlights confidence in execution but also signals valuation sensitivity. Each analyst note typically emphasizes margin stability, advertising monetization, and free cash flow discipline rather than aggressive subscriber projections.

Average Price Target and 12-Month Price Expectations

The average price target remains a central reference point in any netflix stock price prediction. In 2026, analysts have narrowed their forecast ranges compared to earlier years.

Price Target for Netflix (12-Month Horizon)

|

Type of price |

USD Value |

|

Low price target |

$540 |

|

Average price target |

$685 |

|

High price target |

$760 |

The current price target for netflix implies a 9–22% upside from today’s nflx stock price, assuming steady macro conditions. These numbers form the basis of most published analyst price target predictions.

Earnings Performance, EPS Growth and NFLX Financials

In 2026, earnings quality has become the primary driver of sentiment around nflx stock. Netflix has completed its transition from a cash-burning growth company to a mature enterprise with predictable profitability.

- 2026 EPS forecast: $18.40–$19.10

- Expected eps growth: ~15–20%

NFLX Financials Snapshot

|

Metric |

2026 Forecast |

|

Revenue growth |

8–10% |

|

EPS |

$18.40–$19.10 |

|

Operating cash flow |

~$9–10 billion |

|

Free cash flow |

Strongly positive |

These nflx financials confirm that netflix remains financially resilient even as competition intensifies.

Cash Flow, Profitability and Shareholder Value

Strong operating cash flow is now central to the Netflix equity story. Management prioritizes disciplined content investment and selective buybacks, improving long-term shareholder value.

For long-term investors, the predictability of cash generation per quarter matters more than short-term subscriber volatility.

Valuation Analysis and Price-to-Earnings Ratio

At roughly $625 per share, Netflix trades at a forward price-to-earnings ratio of approximately 33–34x. This premium valuation reflects expectations of durable growth, advertising leverage, and global scale.

From a comparative perspective:

- Netflix trades above traditional media peers

- The premium narrows when adjusted for growth quality

- Valuation sensitivity increases during macro tightening cycles

This type of price positioning places Netflix between high-growth technology and defensive media stocks.

Technical Analysis: Price Chart, Candlestick Patterns, and Price Action

From a technical analysis standpoint, the price chart for nflx stock in 2026 shows a well-defined upward trend channel.

Key signals include:

- Bullish candlestick continuation patterns above the 200-day moving average

- Strong support zone near $580

- Resistance zone near $700

Recent price action suggests accumulation by institutional investors rather than speculative trading.

Netflix Stock Forecast for 2026: Bullish and Bearish Scenarios

Bullish Scenario

- Target range: $720–$760

- Drivers: advertising scale, margin expansion, controlled content costs

Bearish Scenario

- Target range: $540–$570

- Risks: macro slowdown, rising content expenses, competition from Warner Bros

Although some contrarian views suggest strong sell, this remains a minority position.

Long-Term Netflix Stock Price Prediction for 2030

Looking toward 2030, forecasts naturally widen. Long-term models suggest:

- Conservative scenario: $750–$820

- Base case: $900–$1,000

- Aggressive bullish case: $1,150+

These projections assume Netflix evolves into a diversified advertising and entertainment platform.

Competitive: Netflix, Warner Bros, and Strategic Risk

Competition remains intense. Strategic shifts by peers such as Warner Bros influence sentiment. Some investors compare allocation decisions and debate whether to buy Warner Bros instead of Netflix based on relative valuation.

Despite competition, Netflix maintains scale advantages in data, technology, and global distribution.

Market Position, ETFs and Index Influence

As a major S&P 500 constituent, Netflix benefits from structural inflows tied to passive investing. Inclusion in large ETFs adds stability to nflx stock during periods of volatility.

Investment Community View: Buy or Sell NFLX Stock in 2026?

Within the investment community, sentiment toward Netflix is balanced but constructive.

- Buy or sell decisions hinge on valuation discipline

- Recommendation trends remain stable

- TipRanks data confirms ongoing institutional support

For many portfolios, nflx stock remains a core holding rather than a short-term trade.

Final Verdict

The netflix stock price prediction for 2026 reflects a fundamentally strong, cash-generative company trading at a premium valuation. The current nflx stock forecast points to moderate upside supported by earnings, improving eps, and disciplined capital allocation.

While not without risks, Netflix continues to justify its position as a high-quality growth asset. For investors seeking exposure to global digital media with predictable cash flow, Netflix remains a compelling — though valuation-sensitive — opportunity in 2026.