Dollar-Cost Averaging in Crypto: A Smart Investment Strategy to Reduce Market Volatility

Navigating the volatile world of crypto investing can be daunting, especially for newcomers. Price swings, emotional trading, and the constant urge to try to time the market often lead to poor decisions. One strategy that can help reduce the impact of market volatility and build wealth over time is dollar-cost averaging (DCA).

What Is Dollar-Cost Averaging and How Does This Investment Strategy Work in Crypto?

Dollar-cost averaging is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the asset's price. This strategy allows investors to buy more units of an asset when the price is low and fewer units when the price is high. The idea is to lower the average cost per share or unit over time.

DCA is especially useful in markets characterized by price volatility, like the crypto market. It reduces the emotional burden of decision-making, minimizes the risks of entering the market at the wrong time, and helps to lower your average purchase price over time.

Why Dollar-Cost Averaging Works Well in the Volatile Crypto Market

Crypto markets are inherently volatile. One day Bitcoin can surge by 10%, and the next, it might crash by 15%. For an inexperienced investor, this can lead to panic selling or impulsive buying. DCA allows you to maintain a steady investment strategy regardless of market movements. When you use dollar-cost averaging, you buy cryptocurrency at regular intervals without trying to time the market.

Trying to time the market is notoriously difficult, even for seasoned traders. A single mistake could mean buying at a peak or selling at a low. DCA eliminates this need by spreading your purchases across different market conditions. By investing regularly, you build a robust crypto portfolio over time and benefit from cost averaging.

How to Use Dollar-Cost Averaging Strategy in Crypto Investing

Suppose you want to invest in crypto but don’t want to commit a large sum at once. You could decide to invest $100 every week into Bitcoin. Regardless of the asset’s price, this fixed amount gets invested consistently. Over the course of months, you'll have accumulated Bitcoin at different price levels, resulting in a more balanced cost basis.

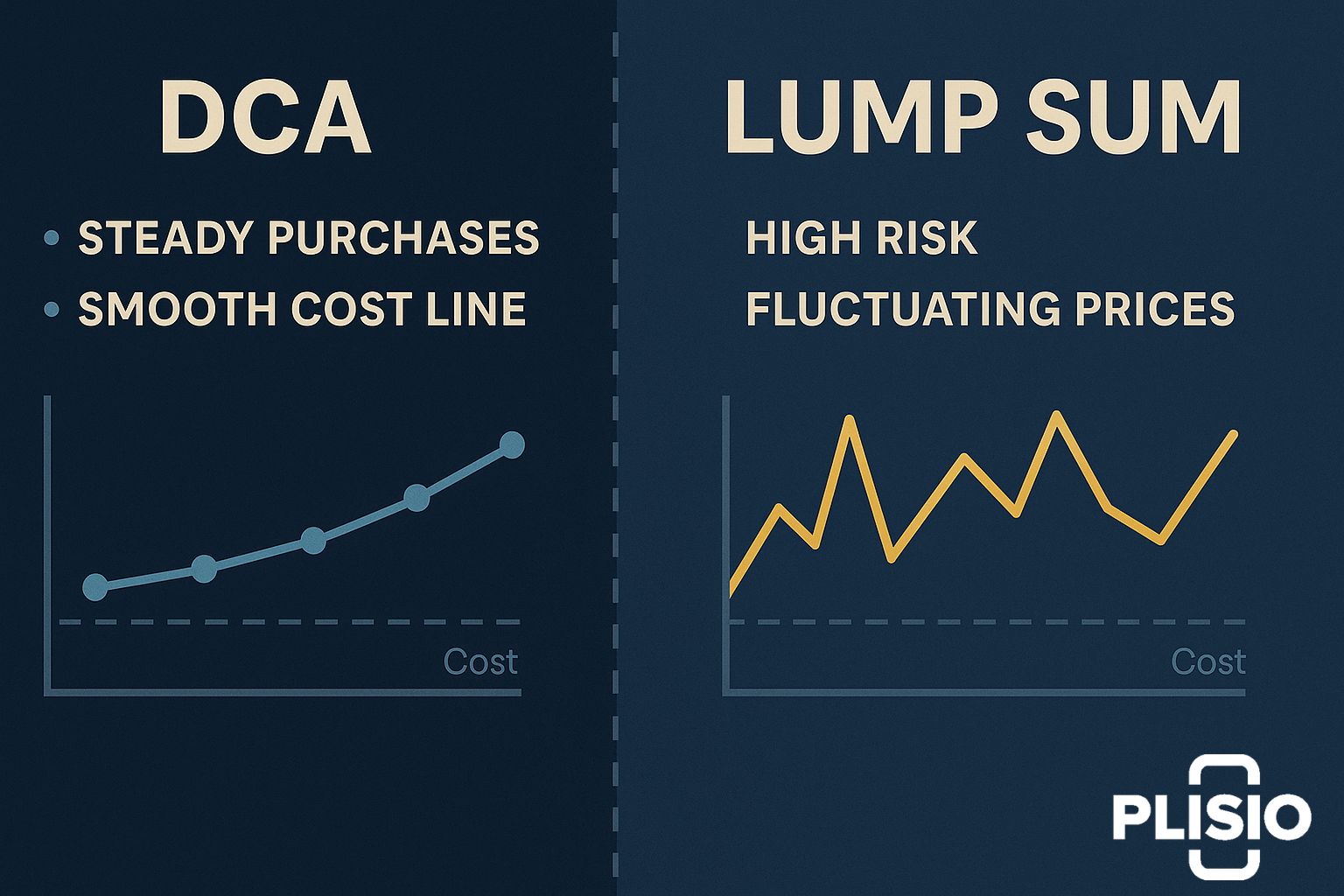

This approach is less risky than investing a lump sum, especially in such a volatile market. It allows you to lower average cost and make consistent purchases, which is especially helpful if prices are low and less predictable.

Psychological Benefits of DCA: Avoid Emotional Trading and Reduce the Impact of Market Volatility

One of the most underestimated benefits of DCA is its ability to reduce emotional trading. Investing often triggers fear and greed, causing investors to make decisions based on short-term market news. With DCA, you're less likely to alter your strategy based on short-term market movements.

Instead of reacting to headlines, you stick to a plan that helps you invest in crypto over time, no matter the price. This long-term discipline can significantly improve your chances of success, especially in an emerging and highly volatile market like crypto.

Top Benefits of DCA Strategy for Crypto Investors

The benefits of DCA go beyond just lowering your average cost per unit. It’s also about making investing easier, especially for those just entering the world of cryptocurrencies. DCA allows investors to:

- Invest regularly without worrying about the right time

- Avoid emotional trading

- Build a diversified crypto portfolio

- Reduce the impact of market volatility

- Lower the average cost per share/unit

- Stick to a long-term investment strategy

Crypto investors who use DCA can focus on the bigger picture and not be swayed by short-term price swings.

Why DCA Is a Long-Term Investment Strategy in Crypto Investing

DCA is a long-term investment strategy. It’s not about getting rich quickly but about building wealth steadily. As you make regular investments over time, you’ll accumulate more units of your chosen digital asset, especially when prices are low. The goal of DCA is to lower the average cost per unit and grow your investment gradually.

Dollar-cost averaging works particularly well when you believe in the long-term potential of a cryptocurrency. Whether it’s Bitcoin or another altcoin, using this strategy helps protect against loss during periods of market downturns.

Drawbacks of Dollar-Cost Averaging: When DCA Might Not Be the Right Crypto Strategy

Despite its benefits, DCA may not be suitable for every investor or market condition. For instance, if an asset is consistently appreciating, a lump sum investment might yield better results. The drawbacks of dollar-cost averaging include:

- May result in lower gains if the asset price rises quickly

- Not ideal for investors with a high-risk appetite or advanced trading knowledge

- Does not protect against fundamental decline in asset value

Moreover, DCA doesn’t guarantee profits. It's a strategy based on reducing risk, not maximizing returns.

When Should You Use a Dollar-Cost Averaging Strategy to Invest in Crypto?

DCA is most effective when:

- You’re new to crypto and unsure how to approach investing

- You want to invest regularly without trying to time the market

- You aim to lower your average purchase price over time

- You believe in the long-term growth of digital assets

This makes it an ideal investment strategy for passive investors who want to build a crypto portfolio gradually without the stress of short-term trading strategies.

Examples of DCA Strategy in Crypto: How Cost Averaging Works Over Time

Let’s say you’ve decided to invest $50 weekly into Ethereum over the course of a month. During weeks when the price is low, your fixed amount buys more ETH. When the price is high, your investment buys less. Over time, this approach helps lower the average price you pay per unit and reduce the impact of market volatility.

|

Week |

ETH Price (USD) |

Investment Amount (USD) |

ETH Purchased |

Cumulative ETH |

Average Cost per ETH (USD) |

|

1 |

2000 |

50 |

0.0250 |

0.0250 |

2000.00 |

|

2 |

2500 |

50 |

0.0200 |

0.0450 |

2222.22 |

|

3 |

1800 |

50 |

0.0278 |

0.0728 |

2062.64 |

|

4 |

2200 |

50 |

0.0227 |

0.0955 |

2093.19 |

This simple table shows how buying more ETH when the price is low and less when the price is high can reduce the average cost per unit. DCA smooths out the cost basis and eliminates the need to predict market trends.

Another example might involve spreading your investments across multiple cryptocurrencies. You might invest in Bitcoin, Ethereum, and Solana at regular intervals. This strategy in crypto can help diversify your holdings and reduce risk.

Conclusion: Is Dollar-Cost Averaging the Right Strategy to Invest in Crypto?

Dollar-cost averaging is an investment strategy that suits a wide range of investors. If you're looking to invest in crypto in a structured, disciplined way without needing to follow daily market movements, DCA might be your best option.

DCA allows you to buy regardless of price and focus on your long-term financial goals. While it may not always outperform lump-sum investments during bullish trends, it offers a safer, more consistent path forward for building crypto investments over time.

To recap, dollar-cost averaging offers a reliable strategy in crypto that can help reduce the impact of volatility, protect against loss, and eliminate the need to time the market. It encourages investing discipline, builds resilience against market fluctuations, and aligns with long-term investment goals.

So whether you’re just starting your crypto journey or are a seasoned investor looking for consistency, consider how averaging works and how it might fit into your broader financial strategy. DCA can help you grow your digital asset holdings steadily—no matter the market conditions.