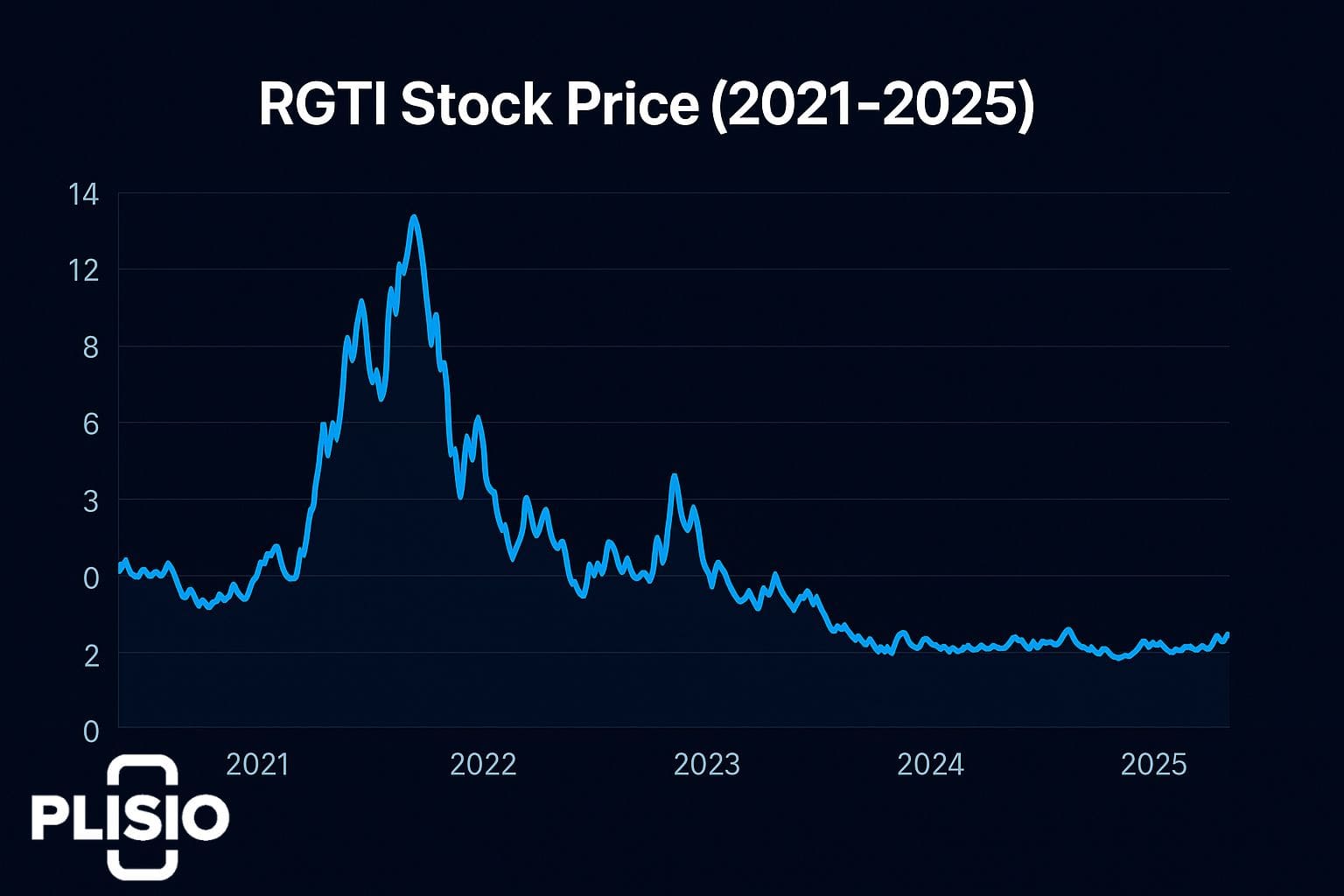

RGTI Stock Price Prediction for 2026 and 2027

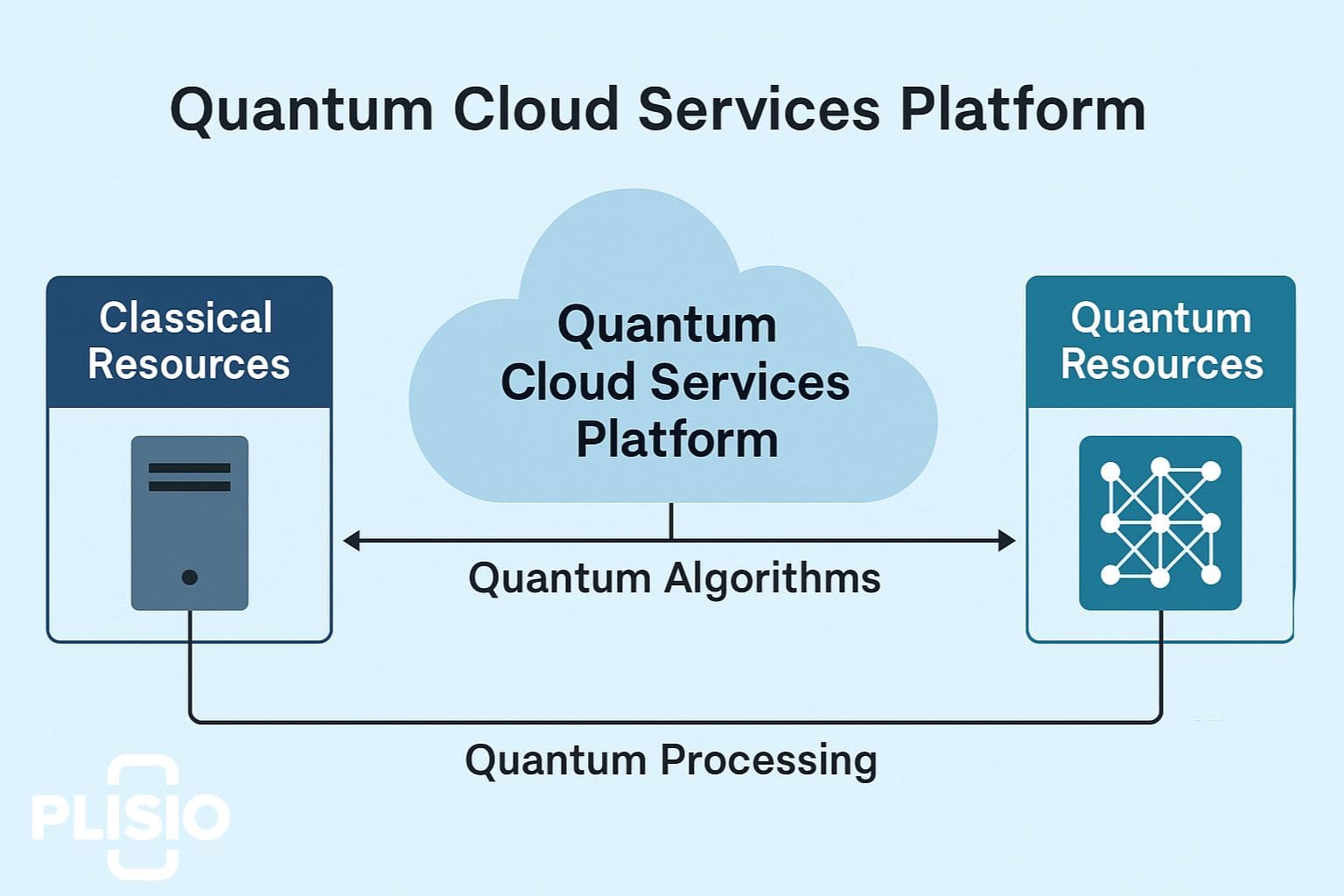

Rigetti Computing, Inc. (ticker RGTI) is firmly positioned as a speculative leader among quantum computing stocks in the modern stock market. Rigetti Computing is headquartered in Berkeley and focuses on building superconducting quantum hardware, including advanced quantum processors, quantum processing units (QPUs), and a full-stack software platform that supports enterprise-grade quantum cloud services and on-prem quantum computing systems.

The investment case for rgti is no longer framed as “early hype” but as a transition phase between research and early commercialization. Any serious stock analysis now revolves around execution, delivery discipline, and the ability to convert technological capability into repeatable revenue.

Latest Rigetti Computing Stock Quote: RGTI Stock Price, Per Share Metrics and Market Cap

Below is an up-to-date stock quote snapshot reflecting current market conditions.

|

Metric |

Value |

|

RGTI stock price |

$24.72 per share |

|

Intraday price range |

$24.66 – $26.64 |

|

Trading volume |

~36.7M |

|

Market cap |

~$8.3B |

|

Exchange |

NASDAQ |

At roughly $25 per share, the stock reflects a valuation based on long-term expectations rather than near-term profitability, a common trait across emerging quantum computing systems developers.

Revenue, Earnings, and Financial Reality Entering 2026

Entering 2026, Rigetti Computing remains pre-profit. Reported revenue over the most recent trailing periods has stayed in the single-digit millions, while earnings remain negative due to sustained R&D investment, infrastructure costs, and non-cash accounting effects.

For investors, this means RGTI stock does not trade on traditional multiples. Instead, valuation is shaped by roadmap credibility, system performance, and customer adoption signals rather than quarterly margin expansion.

RGTI Stock Price Prediction: Stock Forecast Drivers for 2026

The current rgti stock price prediction for 2026 is driven by execution milestones rather than macro optimism alone. The most cited catalysts include:

- Delivery and customer acceptance of the Novera quantum systems, with revenue recognition expected during 2026

- Continued deployment and integration of the Ankaa-3 system and the previously announced 84-qubit architecture

- Expansion of quantum cloud services usage by third-party and enterprise customers

Any material delay in system delivery or performance targets can pressure sentiment, while successful launches tend to support a bullish re-rating.

Analyst Ratings, Consensus Rating, and Price Target Outlook

Current analyst ratings reflect cautious optimism. The prevailing consensus rating trends toward a speculative buy, though opinions remain divided.

Common analyst assumptions include:

- Medium-term revenue growth as quantum systems move from pilot projects to paid deployments

- Improving security, stability, and uptime of quantum processors

- A multi-year pathway toward scalable quantum processing units rather than immediate profitability

Published price target ranges generally cluster from the high-$20s to mid-$30s, with select analysts assigning an outperform view. A minority maintain sell or neutral stances, citing dilution and commercialization risk.

Stock Price Forecast Table: RGTI Stock Forecast for 2026 and 2027

The following stock price forecast represents scenario-based expectations rather than guaranteed outcomes.

|

Year |

Estimated Range |

Key Conditions |

|

2026 |

$18 – $40 |

Timely system delivery, stable market sentiment, execution credibility |

|

2027 |

$25 – $55 |

Clear enterprise adoption, visible revenue growth, stronger margins |

This framework highlights why 2026 and 2027 remain pivotal years for Rigetti Computing.

Short-Term Trend vs Long-Term Outlook for RGTI Stock

In the short-term, the dominant trend in RGTI stock remains momentum-driven. News events, technology announcement cycles, and broader market risk appetite can drive sharp swings that attract active trader participation.

The long-term outlook depends on whether Rigetti can establish durable commercial demand for quantum systems, improve system reliability, and integrate quantum workflows with classical and artificial intelligence workloads.

Investment Decision: How Investors Approach RGTI Stock in 2026

For any investment decision, RGTI stock should be viewed as a high-risk exposure to future computing infrastructure.

- A short-term trade strategy focuses on volatility and sentiment shifts

- A long-term investor approach treats RGTI as a venture-style allocation within a diversified portfolio

There is no one-size-fits-all answer, but disciplined position sizing matters more here than conviction.

Disclaimer

Disclaimer: This article is for informational purposes only and does not constitute investment advice, a recommendation to buy or sell securities, or a promise of future performance. Any price prediction, stock prediction, price chart interpretation, or stock price forecast involves uncertainty. Always conduct independent research and consult qualified professionals before making an investment decision.