Asset Tokenization Explained: Unlocking the Value of Real-World Assets in 2026

As the financial sector embraces digital transformation, the use of blockchain technology and smart contracts is fundamentally reshaping how we define, manage, and exchange value. Asset tokenization is the process of transforming ownership of an asset—such as real estate, equities, or collectibles—into a blockchain-based digital token. This approach provides a modern tokenization solution for making asset classes more liquid, accessible, and efficient.

By mid-2026, the global market capitalization of tokenized real-world assets had surged to $1.24 trillion, up from $865.5 billion in 2024. Projections indicate the tokenized economy could exceed $5 trillion by 2029, signaling widespread adoption of tokenized assets by both institutions and individuals.

"Asset tokenization is one of the most transformative innovations in finance," says Laura Shin, fintech analyst at Global Ledger Insights. "It levels the investment landscape by allowing fractional participation in high-value assets, enabled by blockchain technology."

Asset tokenization is also enabling a broader range of tokenization solutions, giving asset owners the ability to issue digital representations of traditionally illiquid assets. These tokens confer asset ownership rights and are recorded on a blockchain platform, ensuring transparency and enabling seamless asset transactions.

This article provides asset tokenization explained comprehensively, exploring the benefits of tokenization, its use cases across different asset types, and the key challenges of asset tokenization.

Assets Tokenization: Understanding the Process

Tokenization is the process of converting ownership of an asset into digital tokens that can be traded, stored, and transferred via blockchain-based platforms. This method allows fractional ownership of traditionally illiquid assets such as commercial real estate assets, fine art, or venture capital.

In early 2026, the market for tokenized real-world assets expanded by over 260%, growing from $8.6 billion to $23 billion. This momentum was driven by innovative asset tokenization projects targeting a wide range of asset classes.

By reducing dependence on intermediaries, tokenization creates more direct and efficient investment pathways. All transactions are recorded immutably on blockchain platforms, offering security and full traceability for all asset holders.

"We're seeing token standards for asset tokenization evolve to handle increasingly complex use cases," notes Dr. Alex Werner. "The infrastructure is adapting to support everything from real estate and debt to carbon credits and intellectual property."

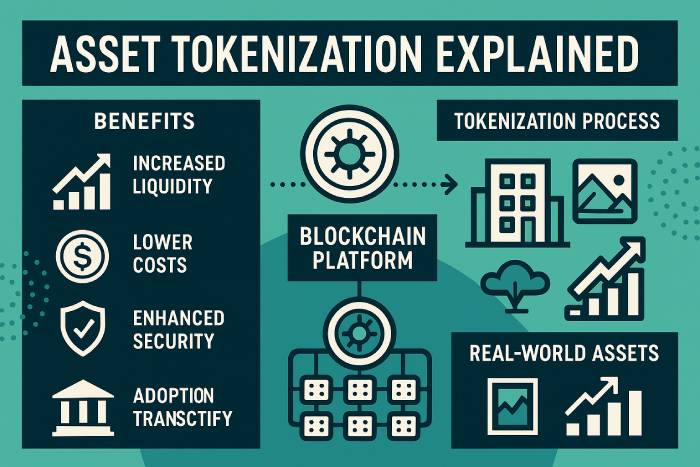

Benefits of Asset Tokenization

The benefits of asset tokenization include:

- Liquidity Creation: Tokenization can unlock liquidity in historically illiquid assets by enabling fractional sales.

- Greater Access: Investors gain exposure to asset classes once limited to high-net-worth individuals or institutions.

- Reduced Transaction Costs: Automation and smart contracts streamline asset transactions, reducing fees and delays.

- Transparency and Security: Blockchain provides immutable records of ownership and transaction history, enhancing trust and regulatory compliance.

Blockchain Technology and Smart Contracts in Tokenization Solutions

Blockchain technology and smart contracts are central to modern asset tokenization solutions. A blockchain-based asset platform operates as a secure, decentralized ledger that tracks the full lifecycle of a tokenized asset—from issuance to transfer.

Smart contracts automate functions like revenue sharing, governance voting, and compliance enforcement. These contracts reduce reliance on traditional financial infrastructure while increasing transparency and speed.

"As central bank digital currencies become more integrated, the convergence with tokenized assets will be pivotal," says Nina Patel, CTO at TokenBridge. "Asset holders are beginning to realize how blockchain infrastructure enhances value retention and transfer."

Tokenizing Real Estate: A Practical Example

A popular use case is the tokenization of real estate assets. To tokenize assets in this class, the owner places the asset into a legal wrapper. Digital tokens are then issued to represent fractional rights to the underlying asset, enabling broader participation.

Smart contracts control income distribution, ownership governance, and property management. Through an asset tokenization platform, investors around the world can gain access to properties that were once financially out of reach.

Key Success Factors in Asset Tokenization Projects

Several elements contribute to the success of asset tokenization:

- Regulatory Frameworks: Compliance with local and international laws is essential.

- Robust Infrastructure: Scalable, secure blockchain technology is needed to tokenize assets effectively.

- User Education: Understanding the benefits of asset tokenization is crucial for adoption.

- Cybersecurity: Strong protections must be in place to defend against attacks and ensure trust.

Expanding Use Cases for Tokenized Assets

Asset tokenization is now being applied to a growing number of sectors:

- Debt Instruments and Bonds: Simplifying issuance, yield distribution, and trading.

- Carbon Markets: Tokenizing carbon credits for real-time tracking and compliance.

- Digital Art and IP: Protecting and monetizing ownership of creative assets.

- Tokenized Money Market Funds: Offering liquid alternatives to traditional short-term investments.

These examples demonstrate how tokenization can also extend beyond financial products to alternative and non-traditional asset classes.

Challenges of Asset Tokenization

Despite progress, the challenges of asset tokenization persist:

- Regulatory Fragmentation: Differences between jurisdictions create legal uncertainty.

- Liquidity Limitations: Early-stage markets may lack deep trading volumes.

- Valuation and Pricing Models: Standardized methods for valuing digital tokens are still emerging.

- Technical Vulnerabilities: Bugs or flaws in smart contracts can undermine trust.

- Market Readiness: Broader awareness and adoption of tokenized assets are still evolving.

Addressing these challenges requires coordination between regulators, platforms, and stakeholders committed to long-term growth.

Conclusion: Tokenization Has the Potential to Reshape Finance

Asset tokenization is one of the most promising developments in modern financial systems. It allows asset owners to unlock value from physical and intangible holdings, enables new forms of fractional investment, and enhances transparency through distributed ledgers.

As blockchain technology to tokenize continues to evolve and token standards mature, the tokenization of real-world assets may become a fundamental layer in financial infrastructure. With more institutions embracing asset tokenization platforms, the move from traditional assets into digital tokens is poised to accelerate.

In a future where assets on the blockchain are the norm, tokenization offers a pathway to greater access, efficiency, and financial innovation for everyone involved in the asset lifecycle.