Crypto Romance Scams: The Rising Tide of Digital Deception

Online dating has created new opportunities for genuine connections—but it has also opened the door to sophisticated financial crimes. Crypto romance scams are a modern blend of emotional manipulation and cryptocurrency fraud, leaving victims not only heartbroken but financially devastated. This article explores how these scams work, the warning signs, and how to protect yourself and others.

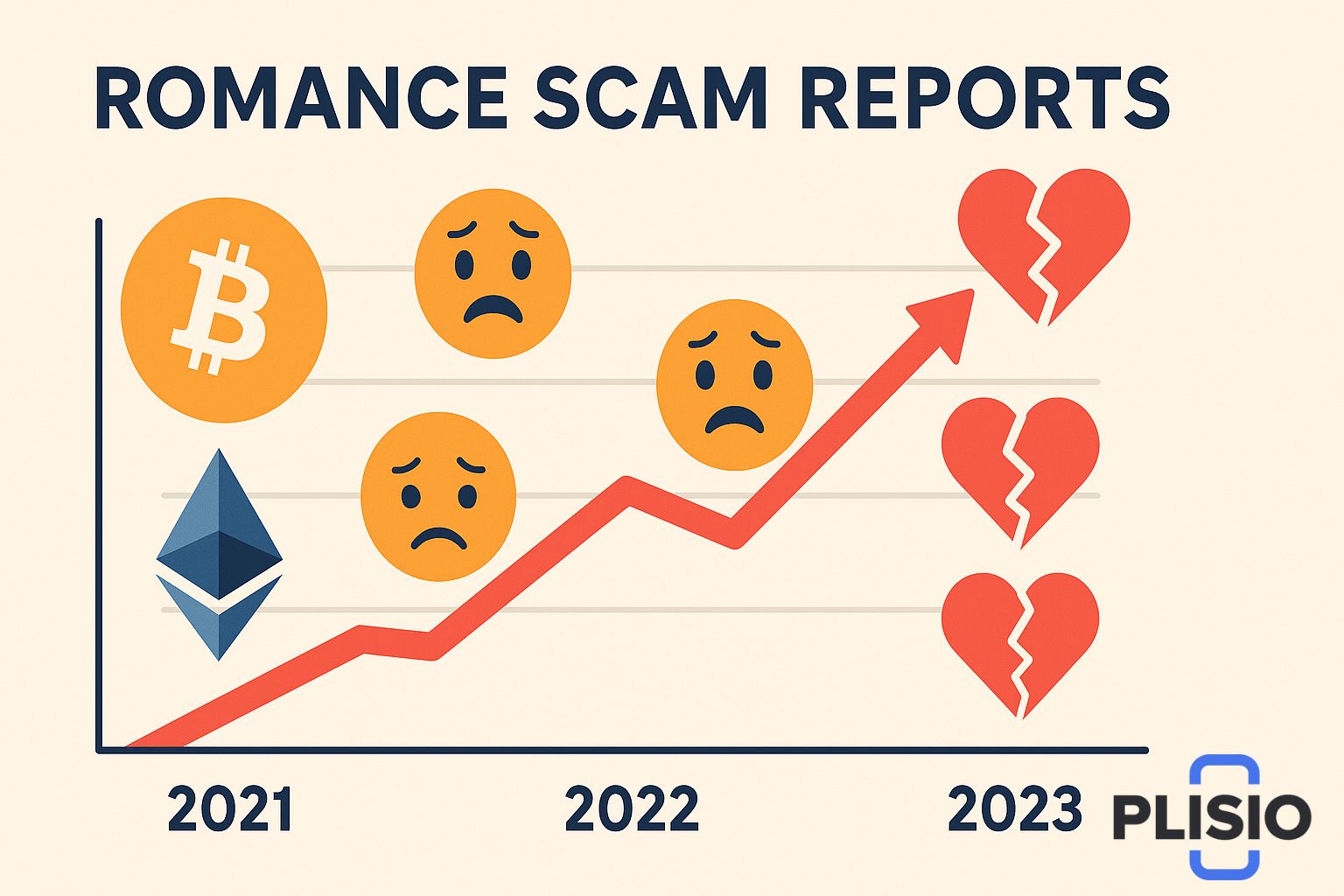

The Rise of Romance Scams in 2021 and Beyond

Online romance has become widespread, but with its popularity has come an increase in romance scams. According to the Federal Trade Commission (FTC), romance scams in 2021 reached record highs, and the trend continued in 2022 and 2023. These scams prey on the emotional vulnerability of users on dating apps, social media platforms, and dating sites.

How Scammers Work in the World of Online Romance

Romance scammers create fake profiles, sometimes even using a profile on LinkedIn to appear legitimate. These fraudsters often start on a dating website or social media site, forming what seems like a genuine online relationship. The tactics used by romance scammers include:

- Creating fake identities

- Emotional manipulation

- Building trust quickly

- Avoiding in-person meetings

They deceive their victims by pretending to be potential romantic partners.

From Emotional Connection to Financial Exploitation

Once trust is established, the scammer may introduce investment scams or encourage the victim to invest in crypto. Common platforms like crypto.com or fake cryptocurrency exchanges are often mentioned. Scammers want your money and will suggest sending sums of money using bitcoin, stablecoins, or wire transfer. They may even send money first to build trust, then ask for larger sums.

Understanding the Pig Butchering Scam

The “pig butchering scam” is a form of fraud scheme where the victim is emotionally ‘fattened’ before being ‘butchered’ financially. These scams often work through fake trading platforms and are linked to criminal organizations. Money sent by the victim ends up in the scammer’s wallet. Victims are frequently financially devastated and unable to get it back.

Red Flag Indicators and Online Fraud Warning Signs

Several red flag indicators can help identify a romance scam. Scammers often say they can’t meet in person, or use excuses such as being abroad. They use WhatsApp or social media sites to maintain contact. Fake profiles on dating sites and dating apps are used to lure victims. Reverse image search is a useful tool to check if personal photos are stolen or fake.

Why You Should Never Send Money to Someone You Haven’t Met

Never send money to someone you met online but haven’t met in person. The FTC advises: talk to someone you trust before making financial decisions. People reported being financially exploited by scammers who often create fake trading platforms. Online accounts are difficult to recover after fraud.

Here is a comparison of legitimate behavior versus common scammer behavior:

|

Behavior Type |

Legitimate Connection |

Romance Scammer Tactic |

|

Communication |

Open, consistent, personal |

Secretive, evasive, manipulative |

|

Meeting in person |

Encouraged |

Always postponed or avoided |

|

Financial discussions |

Rare, cautious |

Frequent, urgent, emotional |

|

Identity verification |

Willing to verify |

Avoids verification |

Advice for Others Who May Be Targets

Advice for others who may be targets includes being cautious on dating websites, avoiding online fraud, and recognizing red flags. If you've been targeted, contact law enforcement agencies immediately. The fraudster’s goal is financial gain, and sums of money sent may be hard to trace due to the nature of virtual currency and cryptocurrency fraud.

Follow these steps if you suspect a scam:

- Stop communication immediately.

- Report the scam to the FTC and local authorities.

- Alert your bank or cryptocurrency exchange.

- Save all communication for evidence.

- Warn others on the platform used.

Protecting Yourself from Crypto Romance Scams

To avoid losing money, be alert on dating sites and apps. Scammers can use any tactic to gain trust. Use reverse image searches and question emotional connections that escalate quickly. Remember, online relationships can lead to financial crimes. Don’t be forced to pay under false pretenses. Be aware of foreign law challenges that make recovery difficult.

Real Victims, Real Consequences

Victims are often left financially devastated. Losing money to a romance scam can impact both finances and mental health. In many cases, the scammer’s wallet is untraceable. Even stablecoins and other virtual currencies can vanish in fraudulent transactions. Scammers work quickly and effectively, making it crucial to act fast.

Conclusion: Awareness Is Your Best Defense

Creating fake profiles, using online dating apps, and exploiting emotions are all part of the scammer's playbook. Always verify information, question urgency, and talk to someone you trust. Online romance should never lead to financial exploitation. Protect yourself and others who may be targets by spreading awareness.