Most Stable Coins to Invest in 2026: A Data‑Driven Guide

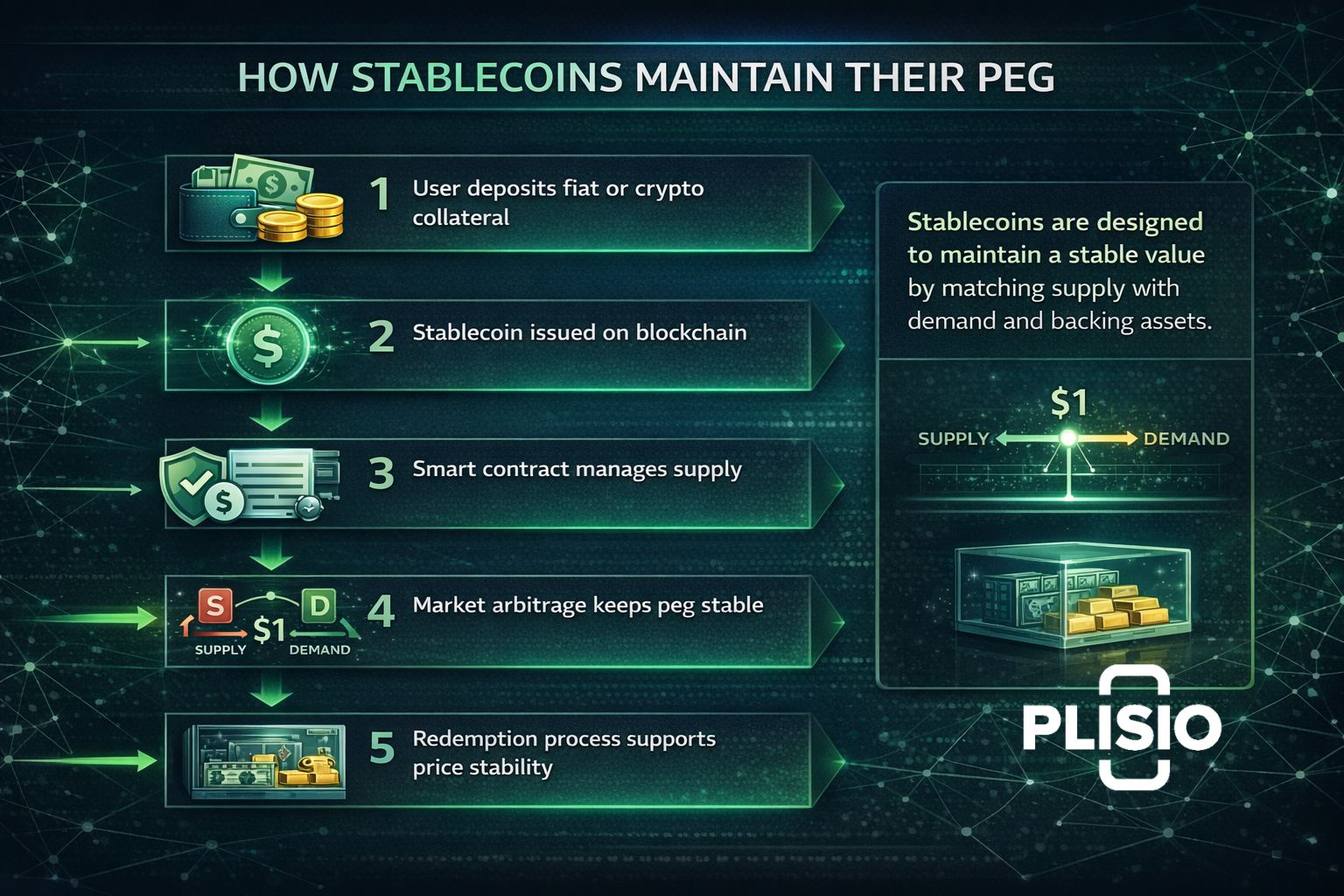

The conversation around stablecoins has changed dramatically over the past few years. Stablecoins are digital currencies that were created to solve one core problem in crypto: volatility. Unlike traditional cryptocurrency assets that experience sharp price swings, stablecoins are designed to maintain a stable value by holding a peg to assets like fiat currencies, commodities, or other collateral structures.

In 2026, stablecoins have become a foundational layer of the crypto market. They are no longer experimental tools used only by traders. Instead, stablecoins play a crucial role in the stablecoin ecosystem, powering trading, payments, lending, remittances, and institutional settlement. This guide explores the most stable coins to invest in, analyzes stablecoins by market capitalization, and explains how to compare stablecoins effectively.

Understanding stablecoins is essential before allocating capital. Stablecoins aim to provide stability in the volatile crypto environment, while still offering the speed and programmability of blockchain technology.

What Are Stablecoins and How Do They Work?

Stablecoins are digital currencies issued on a blockchain that are pegged to an external reference asset. In most cases, stablecoins are pegged to the US dollar, though some track euro, gold, or other assets like fiat currencies.

A stablecoin is a cryptocurrency designed to maintain a fixed peg and maintain a stable value through reserve backing or algorithmic supply adjustments. Stablecoins operate through smart contract logic and reserve management systems that are designed to maintain a stable relationship between supply and demand.

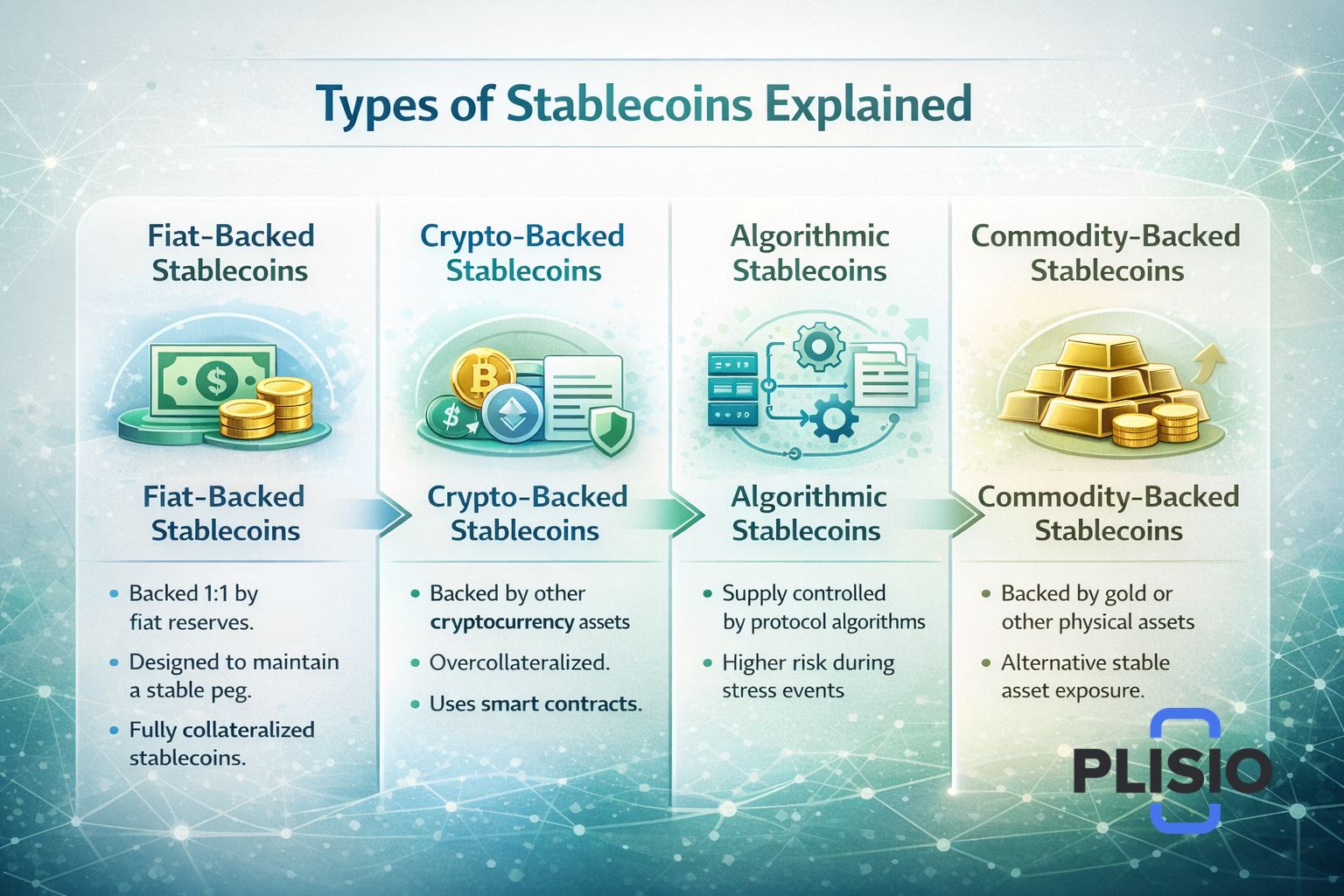

There are many types of stablecoins available today. The main types of stablecoins include:

- Fiat-backed stablecoins

- Crypto-backed stablecoins

- Algorithmic stablecoins

- Commodity-backed stablecoins

Each category has different risk characteristics and backing structures.

Fiat-Backed Stablecoins

A fiat-backed stablecoin holds reserves in fiat currency such as USD or EUR. These fully collateralized stablecoins are typically backed 1:1 by bank deposits or short-term government securities. Fiat-backed stablecoins are often considered the most conservative option for investors seeking stability in crypto.

Crypto-Backed Stablecoins

Crypto-backed stablecoins use other cryptocurrency assets as collateral. These stablecoins are often overcollateralized to absorb volatility shocks. They rely heavily on smart contract automation.

Algorithmic Stablecoins

Algorithmic stablecoins and a pure algorithmic stablecoin model attempt to stabilize supply without direct fiat reserves. While algorithmic stablecoins can offer capital efficiency, history has shown that some designs may struggle under stress conditions.

Commodity-Backed Stablecoins

Commodity-backed stablecoins are backed by assets such as gold. These stablecoins include tokens representing physical reserves stored in vaults.

Stablecoins differ in transparency, liquidity, and risk exposure. Choosing the right stablecoin requires understanding these structural differences.

Stablecoin Market Overview in 2026

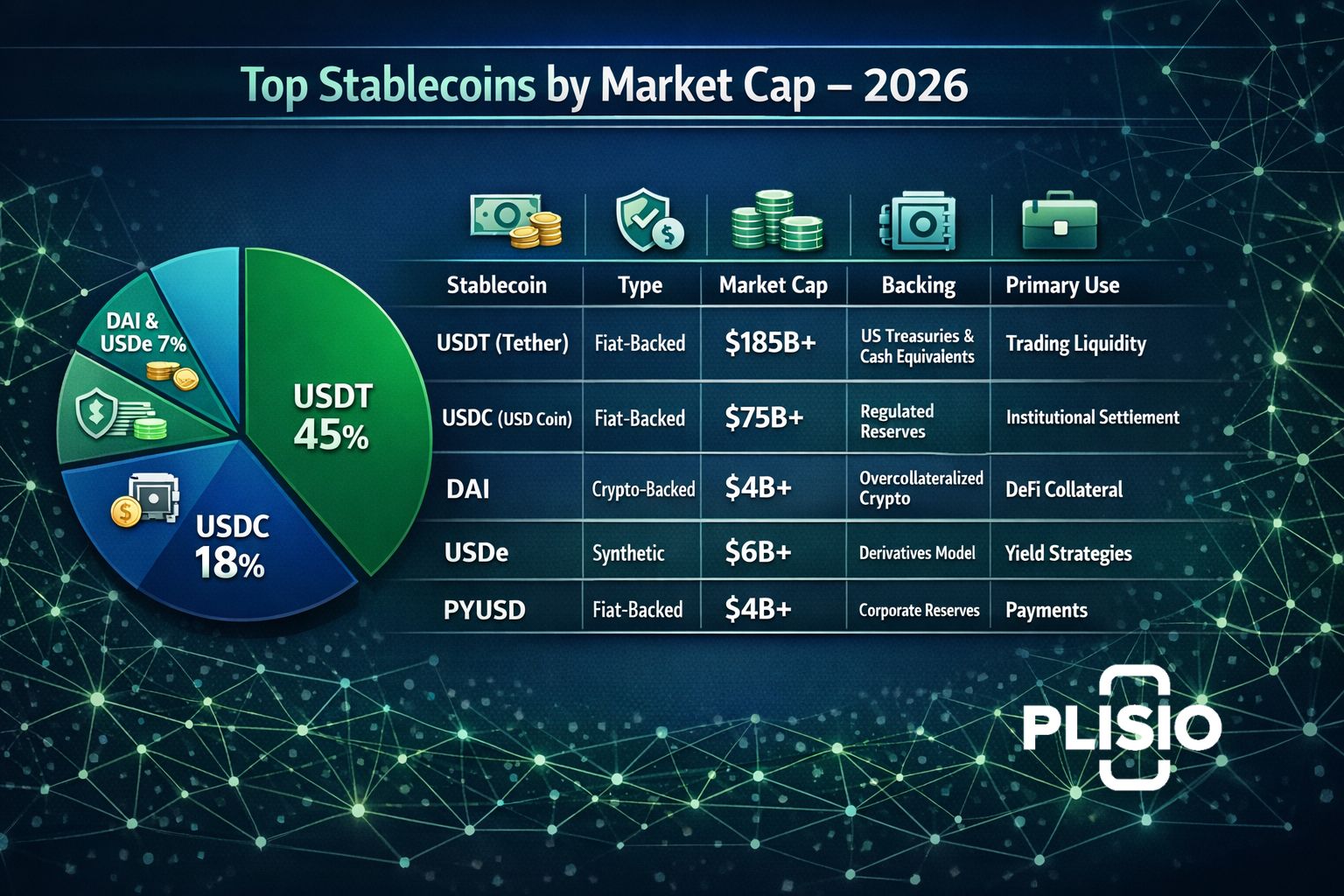

The stablecoin market has expanded significantly. As of early 2026, total stablecoins by market capitalization exceed $300 billion in market capitalization, reflecting growing institutional and retail demand for stable assets.

The demand for stablecoins continues to rise due to:

- Increased use of stablecoins in cross-border settlement

- Integration by major fintech platforms

- Expansion of decentralized finance

- Growth of emerging market adoption

Stablecoins are no longer niche instruments. Including stablecoins in portfolios has become common among both traders and long-term investors seeking stability in the volatile crypto market.

Top Five Stablecoins by Market Cap in 2026

Below is a table showing five stablecoins that dominate the stablecoin by market cap rankings.

|

Rank |

Name |

Type |

Approx. Market Cap |

Notes |

|

1 |

tether (USDT) |

fiat-backed stablecoin |

$185B+ |

Most widely used stablecoin |

|

2 |

usd coin (USDC) |

fiat-backed stablecoin |

$75B+ |

second-largest stablecoin by market cap |

|

3 |

DAI |

crypto-backed stablecoin |

$4B+ |

Decentralized collateral model |

|

4 |

USDe |

hybrid model |

$6B+ |

Derivatives-based structure |

|

5 |

PYUSD |

fiat-backed stablecoin |

$4B+ |

Corporate-backed stablecoin issued by PayPal |

These leading stablecoins represent the majority of stablecoins by market capitalization.

Tether (USDT)

Tether remains the major stablecoin in terms of liquidity. Stablecoins such as USDT are widely available on every major crypto exchange. Tether has become the stablecoin of choice for many traders due to its deep liquidity pools and extensive blockchain integrations.

USD Coin (USDC)

Usd coin is widely recognized for regulatory transparency and reserve attestations. Stablecoins like USDC are frequently preferred by institutions due to compliance standards and integration with payment processors. USDC is the second-largest stablecoin by market cap and a popular stablecoin in enterprise settlement.

DAI and Other Alternatives

Another stablecoin worth mentioning is DAI, which represents a decentralized model. New stablecoins continue to enter the market, but only a few achieve large market cap milestones.

Key Features of Major Stablecoins

|

Feature |

USDT |

USDC |

DAI |

USDe |

PYUSD |

|

Backing |

Fiat reserves |

Fiat reserves |

Crypto collateral |

Synthetic |

Fiat reserves |

|

Transparency |

Moderate |

High |

On-chain |

Moderate |

High |

|

Primary Use |

Trading |

Institutional settlement |

DeFi |

Yield strategies |

Payments |

|

Blockchain Support |

Multi-chain |

Multi-chain |

Ethereum-based |

Multi-chain |

Ethereum-based |

This table helps compare stablecoins in practical terms.

Why Investors Look at Stablecoins

Stablecoins offer several advantages compared to volatile cryptocurrency assets:

- Protection from price swings

- Immediate liquidity in the volatile crypto market

- Efficient settlement across borders

The use of stablecoins is expanding in both retail and institutional markets. Stablecoins provide stability in the volatile crypto economy while allowing fast digital transfers.

Stablecoins are often used as a stable asset during uncertain macroeconomic periods. Stablecoins enable traders to exit positions quickly without converting back to fiat through traditional banks.

Regulatory Landscape for Stablecoins in 2026

The regulatory landscape for stablecoins has matured significantly. In 2026, clearer guidelines in the US, Europe, and Asia have helped legitimize stablecoins as digital payment instruments. Regulation could make stablecoins safer, though compliance requirements also increase operational costs.

Stablecoins have become increasingly integrated into payment systems. Financial institutions now integrate stablecoins into treasury operations and settlement layers.

Choosing the Right Stablecoin

Choosing the right stablecoin depends on your objective. When choosing the right option, investors should consider:

- Reserve transparency

- Market cap strength

- Blockchain support

- Counterparty risk

Choosing the right stablecoin to use requires analyzing liquidity depth and redemption processes.

Two stablecoins dominate global liquidity: tether and usd coin. However, many stablecoins exist beyond these leaders.

Risks Associated With Stablecoins

While stablecoins are designed to maintain a stable peg, risks remain:

- Reserve mismanagement

- De-pegging during extreme stress

- Regulatory intervention

- Smart contract vulnerabilities

Stablecoins might appear low risk compared to volatile cryptocurrency assets, but investors must still conduct due diligence.

Algorithmic stablecoins in particular carry structural risks. An algorithmic stablecoin without sufficient collateral support may fail under market pressure.

The Role of Stablecoins in the Crypto Economy

The role of stablecoins extends beyond trading. Stablecoins play a vital role in liquidity provisioning, decentralized finance, payroll distribution, and global remittances.

Stablecoins operate as bridges between traditional fiat systems and blockchain networks. They provide a stable medium of exchange within the world of stablecoins and broader digital finance.

Making stablecoins sustainable requires transparency and strong governance. As the crypto market evolves, stablecoins are no longer speculative experiments — stablecoins have become essential infrastructure.

Stability in Crypto: Long-Term Outlook

Stability in crypto increasingly depends on robust reserve backing and regulatory clarity. Stability in the volatile environment will remain the core selling point of stablecoins.

Stablecoins aim to provide a stable alternative to traditional currency settlement. Stablecoins include fiat-backed stablecoins, crypto-backed stablecoins, and commodity-backed stablecoins.

The future of stablecoins looks strong as adoption grows in emerging markets and institutional finance. Discover the best opportunities requires analyzing stablecoin by market metrics and transparency reports.

Final Thoughts

Stable coin investments are typically less about price appreciation and more about capital preservation. Stablecoins are digital currencies that help investors navigate the volatile crypto market with reduced exposure to extreme price swings.

The best stablecoins in 2026 continue to be those with strong liquidity, transparent reserves, and proven resilience. Whether using stablecoins for trading, hedging, or payments, understanding stablecoins thoroughly is essential.

Stablecoins are designed to maintain stability in the volatile crypto economy, and stablecoins provide a reliable mechanism to move value globally. In a market defined by uncertainty, stablecoins remain a core building block of digital finance.