Crypto Mining Rigs: A Guide from CPUs to GPUs to ASICs

Cryptocurrency mining plays a pivotal role in bolstering the security of blockchain networks. This process not only acts as a safeguard against potential threats but also offers financial rewards to miners, encouraging them to participate actively in maintaining the network's integrity. Mining configurations, often referred to as rigs, are diverse in terms of cost, size, scalability, performance, and energy efficiency.

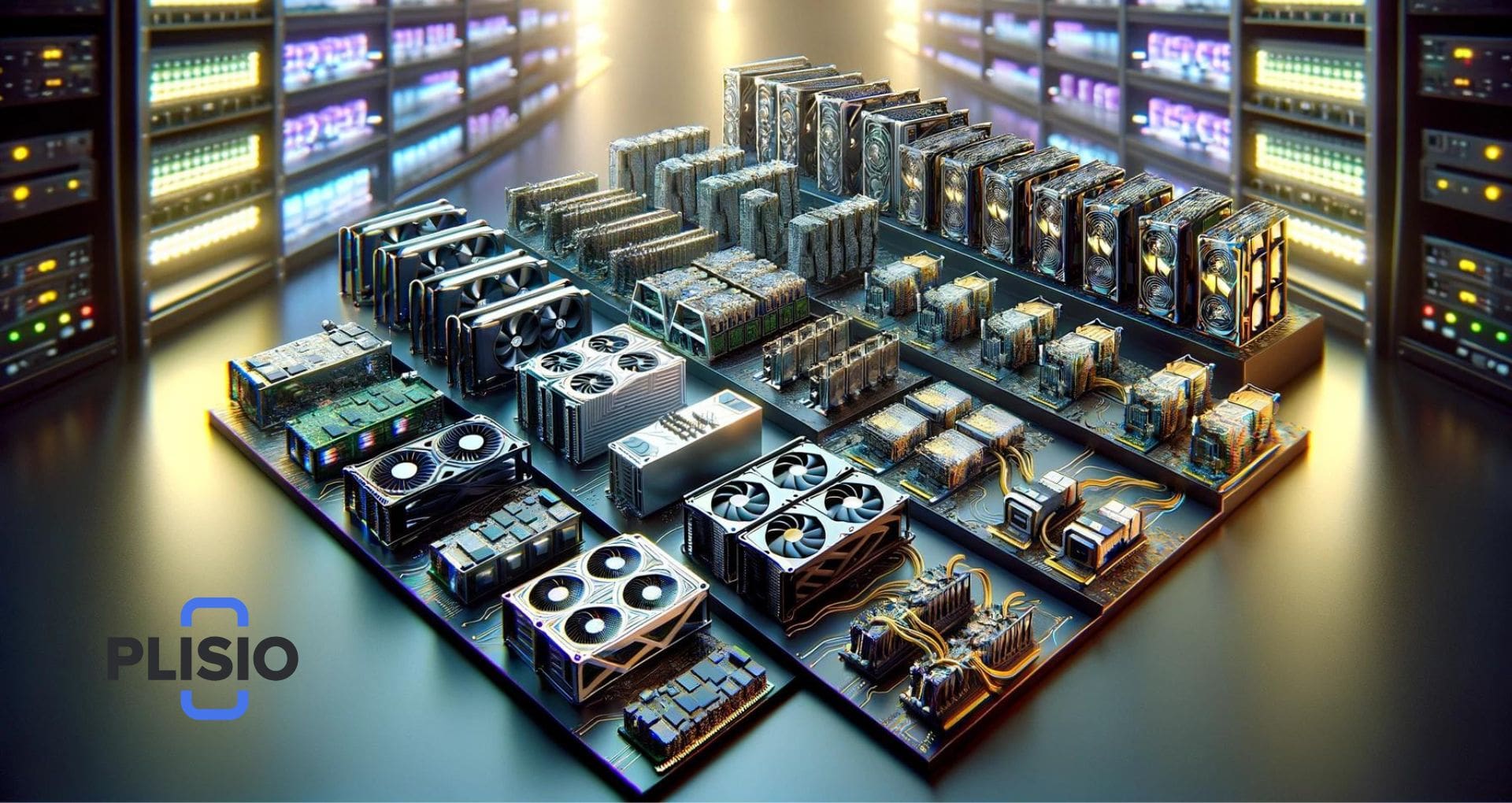

At the heart of a mining operation lies the hardware, which can range from Central Processing Units (CPUs) and Graphics Processing Units (GPUs) to more specialized equipment like Field-Programmable Gate Arrays (FPGAs) and Application-Specific Integrated Circuits (ASICs). When selecting a mining rig, several critical factors come into play: the initial investment cost, the power consumption, the system's adaptability to different mining tasks, and the hash rate — essentially the rig's ability to solve complex cryptographic puzzles at speed.

Crypto Mining Rigs: Types, Configurations, and Sizes

Cryptocurrency mining harnesses computer hardware to power the computational efforts essential for the functioning of blockchain networks. This process not only fortifies the security of these networks against potential threats but also offers financial incentives to participants, rewarding them with the network's native currency for successfully solving complex cryptographic puzzles. The devices and systems employed in this endeavor, known as crypto mining rigs or bitcoin miners among other terms, vary widely in their design and capabilities. From specialized circuits engineered for mining to versatile, general-purpose systems akin to personal computers, the range of hardware options available for cryptocurrency mining is broad and diverse.

Mining rigs are pivotal in networks that employ the Proof of Work (PoW) consensus mechanism. This system ensures the secure processing and verification of transactions, preventing double-spending and other forms of cyber attacks. Bitcoin stands as the most iconic example of a PoW blockchain, though other significant networks, including Ethereum 1.0, operate under the same principle. This article aims to explore the spectrum of mining technologies, from generic computing setups to tailor-made mining apparatuses. For those new to the topic and seeking a foundational understanding of crypto mining and its role in network security, our detailed examination of Bitcoin's network safeguards is a recommended starting point.

When evaluating mining rigs, two factors typically stand out: the hash rate and energy consumption. The hash rate, expressed in hashes per second (h/s), gauges the machine's capacity to tackle and solve the cryptographic challenges necessary to claim mining rewards. Energy efficiency, measured in hashes per kilowatt-hour, alongside the total power usage, also plays a crucial role, directly impacting profitability. Without sufficient computational power and energy efficiency, the cost of electricity can exceed the value of earned rewards, rendering mining endeavors unprofitable. While some individuals mine to contribute to the security and decentralization of networks, the primary motivation for many miners remains the potential for profit.

CPU Mining: Obsolete or Still in Play?

CPU mining involves using the central processing unit (CPU) of a computer to mine cryptocurrency, a method once common in the nascent stages of the crypto world. CPUs, integral to both laptops and desktops, played a crucial role in the early days of Bitcoin mining. Back then, the Bitcoin network was just starting, and the low number of participants coupled with a modest overall hash rate meant that mining with a CPU was not only possible but practical. This scenario allowed early miners to reap rewards using the same hardware that powered their daily computing tasks.

However, the landscape of Bitcoin mining has dramatically transformed since those early days. With the surge in Bitcoin's popularity, the mining arena became significantly more competitive, rendering CPU mining for Bitcoin and other major cryptocurrencies with large market capitalizations virtually obsolete. The escalation in competition necessitated more powerful and specialized hardware to stay profitable.

Yet, it's important to note that CPU mining has not disappeared entirely. Certain cryptocurrencies, such as Bytecoin, Zcash, and Monero, deliberately employ mining algorithms that favor CPUs. The motivation behind these choices is to democratize the mining process, allowing individuals with standard computer hardware to compete effectively against large-scale mining operations. This approach not only champions fairness but also aims to preserve the decentralized ethos of cryptocurrency mining by preventing the concentration of mining power.

Despite these niches where CPU mining remains feasible, it's largely overshadowed in the broader landscape by more efficient technologies. Modern CPU mining, especially on larger Proof of Work (PoW) blockchains, faces significant disadvantages in terms of electricity consumption and hash power when compared to GPUs and ASICs. Measured in kilohashes per second (kh/s), where one kh represents 1,000 hashes, CPUs now find themselves outmatched in a field that demands ever-increasing computational power to remain competitive.

GPU Mining: Setting the New Gold Standard in Crypto

The landscape of cryptocurrency mining has experienced a significant evolution, driven by the surging interest in blockchain technologies and the expanding community of miners vying for rewards. This competitive environment has ushered in a shift from traditional CPU mining to the adoption of graphics processing units (GPUs) for enhanced efficiency and superior hash rates. The genesis of GPU mining software in 2010 marked a pivotal turn in mining strategies, favoring the advanced capabilities of GPUs over CPUs.

GPUs outperform CPUs not only in speed, with hash rates measured in megahashes per second (mh/s) as opposed to kilohashes (kh/s) but also in scale. To illustrate, a single GPU capable of achieving a 40 mh/s hash rate can outpace a 20 kh/s CPU miner by a factor of 2,000. This stark difference is attributable to the GPU's ability to execute numerous operations simultaneously, a feat that CPUs cannot match. Many miners have capitalized on this advantage by assembling rigs equipped with 6-12 GPUs, significantly amplifying their mining power. Enthusiasts with a more robust setup might operate multiple rigs concurrently, with some household setups boasting up to 24-48 GPU units.

GPUs not only excel in speed and efficiency but also offer versatility, enabling the mining of various cryptocurrencies across different blockchains and algorithms. Among the assortment of coins suitable for GPU mining, Ethereum (ETH) has emerged as a frontrunner, particularly noted in 2021. Nonetheless, the anticipated transition of Ethereum to a Proof of Stake (PoS) model poses a potential pivot point for GPU miners, prompting a search for new, profitable mining avenues.

While GPUs quickly overtook CPUs as the preferred mining hardware, their dominance in the Bitcoin mining arena was relatively brief. By 2015, the scene had been dominated by Application-Specific Integrated Circuits (ASICs), marking another transformative chapter in the ongoing evolution of cryptocurrency mining hardware.

ASIC Miners: The New Kings of Bitcoin (BTC) Mining

An ASIC miner, standing for application-specific integrated circuit, is meticulously engineered to perform a singular task: mining cryptocurrency efficiently. Since their market debut in 2012, ASIC miners have significantly outpaced their predecessors, such as GPU miners, in terms of raw computational power. Originally outperforming GPU miners by up to 200 times, the evolution of ASIC technology has continued unabated. By 2021, leading ASIC miners boasted computing capabilities of 90-100 terahashes per second (th/s), dwarfing the most advanced GPU miners. A terahash represents a trillion hashes, showcasing the immense power ASIC miners bring to the cryptographic calculations necessary for mining Bitcoin and other cryptocurrencies.

However, as we move into 2024, the adoption and impact of ASIC miners in the crypto mining industry have been nuanced. Their high cost, ranging between $2,000 to $15,000 USD, poses a significant initial investment hurdle. The profitability of such an investment hinges on various factors, including electricity costs, network difficulty, and the inherent volatility of the cryptocurrency markets. The economic model of ASIC mining often necessitates operation on a large scale, with some setups housing hundreds or even thousands of units to stay competitive.

ASIC miners are also characterized by their specialization. Each unit is typically optimized for mining a specific cryptocurrency or algorithm. For instance, a miner designed for Bitcoin's SHA-256 algorithm may not be efficiently used for mining coins that utilize different algorithms. This specificity contributes to the ongoing relevance of GPU mining for certain blockchain projects.

Yet, the landscape continues to evolve. Some blockchains, like Monero and Ravencoin, have intentionally adopted ASIC-resistant algorithms to maintain mining accessibility and fairness. Despite these challenges, ASIC technology has expanded into mining for Litecoin (LTC), Ethereum (ETH), and other cryptocurrencies, adapting to various algorithms beyond SHA-256.

By 2024, the crypto mining sector has witnessed further advancements in ASIC technology, with new models offering even greater efficiency and power. The introduction of ASIC miners tailored to additional cryptocurrencies and algorithms, including those previously considered ASIC-resistant, underscores the dynamic and rapidly changing nature of cryptocurrency mining. Despite the debates around centralization and accessibility, ASIC miners have undeniably shaped the mining strategies and profitability landscapes for Bitcoin and beyond.

FPGA Miners: The Ideal Hybrid for Crypto Mining?

Field-Programmable Gate Array (FPGA) miners represent a compelling fusion of efficiency and versatility in the realm of cryptocurrency mining. Positioned between the raw power of ASIC miners and the adaptability of GPUs, FPGAs offer a unique advantage: they combine significant computational speed with the capacity to adapt to various cryptocurrencies, a feature that ASICs often lack. This dual capability has led many in the mining community to view FPGAs as an optimal mining solution, striking a balance between high-performance hashing and the flexibility to switch between different coins or algorithms as market dynamics change.

FPGAs are termed "field-programmable" because they can be reprogrammed to suit different purposes or optimize specific tasks, such as cryptocurrency mining, even after being deployed. This programmability leverages logic gates, which are the building blocks that can be tailored to enhance mining efficiency for a particular cryptocurrency algorithm.

The performance of FPGA miners can span a broad spectrum, with outputs ranging from a few hundred kilohashes per second (kh/s) to over 20 gigahashes per second (gh/s), where one gigahash equals a billion hashes. This variance in performance underscores the adaptability of FPGAs to different mining challenges. However, the cost of entry for FPGA mining varies widely too, with units priced between $200 and $6,000, reflecting the diversity in capabilities and potential profitability of these devices.

Despite their advantages, FPGA miners are not without their challenges. The initial setup and ongoing optimization of FPGA systems can be complex, often requiring a deeper technical understanding than other mining solutions. Miners might need to develop or modify the gate array configurations and software themselves to maximize efficiency. Alternatively, downloading a pre-designed bitstream or FPGA mining algorithm can simplify the process, albeit potentially at the cost of a developer fee, which might consume up to 8% of mining profits.

As of 2024, the evolving cryptocurrency mining landscape continues to demand more efficient, versatile, and cost-effective mining solutions. FPGA miners, with their blend of power and adaptability, stand out as a significant option for those looking to navigate the complexities of mining various cryptocurrencies, balancing the quest for profitability with the need for operational flexibility.

Cloud Mining: Your Gateway to Rigless Cryptocurrency Harvesting

Cloud mining presents a streamlined alternative for individuals looking to delve into cryptocurrency mining without the traditional barriers associated with the setup and operation of physical mining rigs. This method allows miners to leverage the power of cloud computing to mine cryptocurrencies through a service or contract purchased from a cloud mining provider. In essence, it's akin to how one might use cloud storage services for data, offering a hands-off approach to mining that sidesteps the direct investment in, and maintenance of, costly mining equipment.

Cloud mining contracts are available in a variety of durations, from short-term agreements lasting a few weeks to long-term commitments that can span several years, and they offer varying levels of hash power. These arrangements can often be more economically viable compared to individual mining setups. Cloud mining companies operate extensive data centers equipped with high-performance ASIC mining rigs, benefiting from economies of scale that individual miners might not easily achieve.

An alternative within the cloud mining model is the remote rental of ASIC miners, though this practice has waned in popularity. It offers miners greater control over their mining operations but comes with additional responsibilities, including higher setup and maintenance costs or the need for significant technical expertise for those opting to configure the hardware remotely.

However, prospective cloud miners should proceed with caution, especially during periods of high demand when contracts may be scarce due to sell-outs. The importance of selecting a reputable cloud mining provider cannot be overstated, given the industry's history with exit scams. These scams involved fraudulent entities offering cloud mining contracts, only to disappear with the investors' funds without fulfilling the mining service agreements. As of 2024, the cloud mining landscape has evolved, offering more secure and transparent options, but the need for due diligence remains critical to ensure a safe and potentially profitable mining venture.

Is There a Future for Crypto Mining Rigs and PoW Blockchains?

The landscape of cryptocurrency mining, whether through the use of GPUs, FPGAs, ASICs, or cloud mining services, continues to be a pivotal component of blockchain technology's backbone. Despite the emergence and growth of Proof-of-Stake (PoS) networks, which eliminate the need for mining, the interest in and the market for mining capable coins remain robust. This is evidenced by the difficulty in acquiring top-tier ASIC miners, which are often sold out due to high demand, even on secondary markets. The increasing hash rates across Bitcoin and other leading Proof-of-Work (PoW) projects further underscore the enduring appeal and relevance of mining hardware.

However, the advent of accessible trading platforms has introduced a more straightforward — and for some, more appealing — avenue for acquiring cryptocurrencies. Both centralized exchanges (CEXs) and decentralized exchanges (DEXs) offer potential investors an easier and potentially more lucrative path to owning digital assets without the complexities associated with mining.

Ultimately, the choice between engaging in mining or buying cryptocurrencies outright is influenced by individual preferences and considerations. Factors such as investment strategy, desired level of involvement, risk tolerance, technical expertise, and financial objectives play significant roles in this decision-making process. As the crypto landscape evolves, the coexistence of various acquisition methods, including mining and direct purchase, highlights the diverse approaches individuals can take towards participating in the digital asset economy.